| Payment of Filing Fee (Check the appropriate box): | ||||||||||||||

| x | No fee required. | |||||||||||||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i) | |||||||||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||||||||

| (5) | Total fee paid: | |||||||||||||

| o | Fee paid previously with preliminary materials. | |||||||||||||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

| (1) | Amount Previously Paid: | |||||||||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||||||||

| (3) | Filing Party: | |||||||||||||

| (4) | Date Filed: | |||||||||||||

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

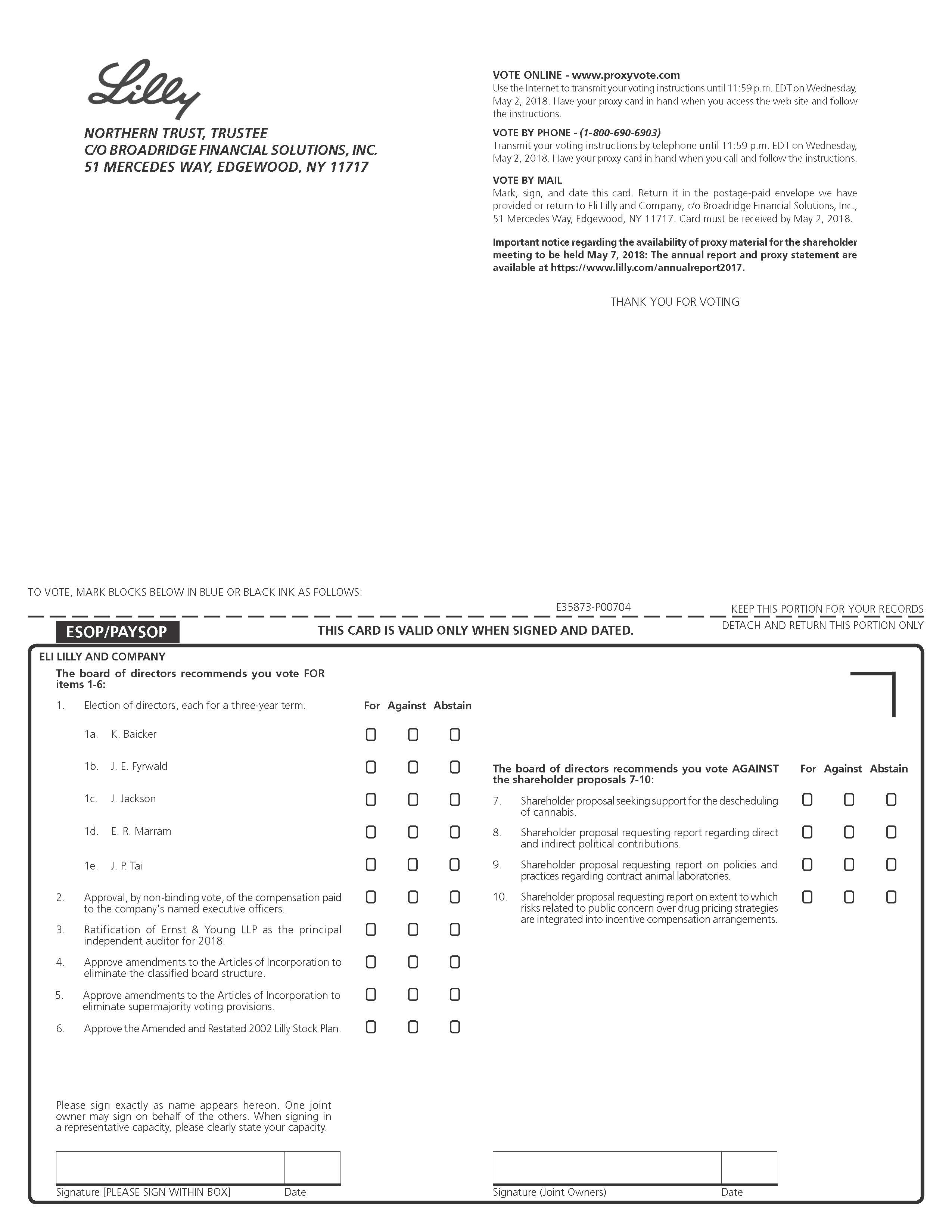

Notice of 20182021 Annual Meeting of Shareholders and Proxy Statement

Your vote is important

Please vote online, by telephone, or, if you received or requested paper copies of your proxy materials, by signing, dating, and returning the enclosedyour proxy card by mail.

Important notice regarding the availability of proxy materials for the shareholder meeting to be held May 7, 2018:3, 2021: The annual report to shareholders and proxy statement are available at https://www.lilly.com/annualreport2017.lilly.com/policies-reports/annual-report.

From Our Chairman and Lead Independent Director

Dear fellow Lilly shareholders,

As we turn the page on an extraordinary year, we would like to thank you for your continued support of Eli Lilly and Company. We are proud of Lilly's achievements in 2020, which demonstrated our conviction to unite caring with discovery to create medicines that make life better for people around the world. In addition to developing potential therapies for COVID-19 and partnering with governments to make COVID-19 antibody treatments available regardless of income level or geography, we continued to advance our pipeline to help people with diabetes, immune disorders, neurodegeneration, cancer, and pain.

Due to concerns regarding the ongoing COVID-19 pandemic and to support the health and well-being of our employees, board of directors, shareholders, and other meeting participants, the 2021 Annual Meeting of Shareholders (the Annual Meeting) will be held virtually via live webcast. Although you will not be able to attend the Annual Meeting at a physical location, we have designed the Annual Meeting live webcast to provide shareholders the opportunity to participate virtually to facilitate shareholder attendance and to provide a consistent experience to all shareholders, regardless of location.

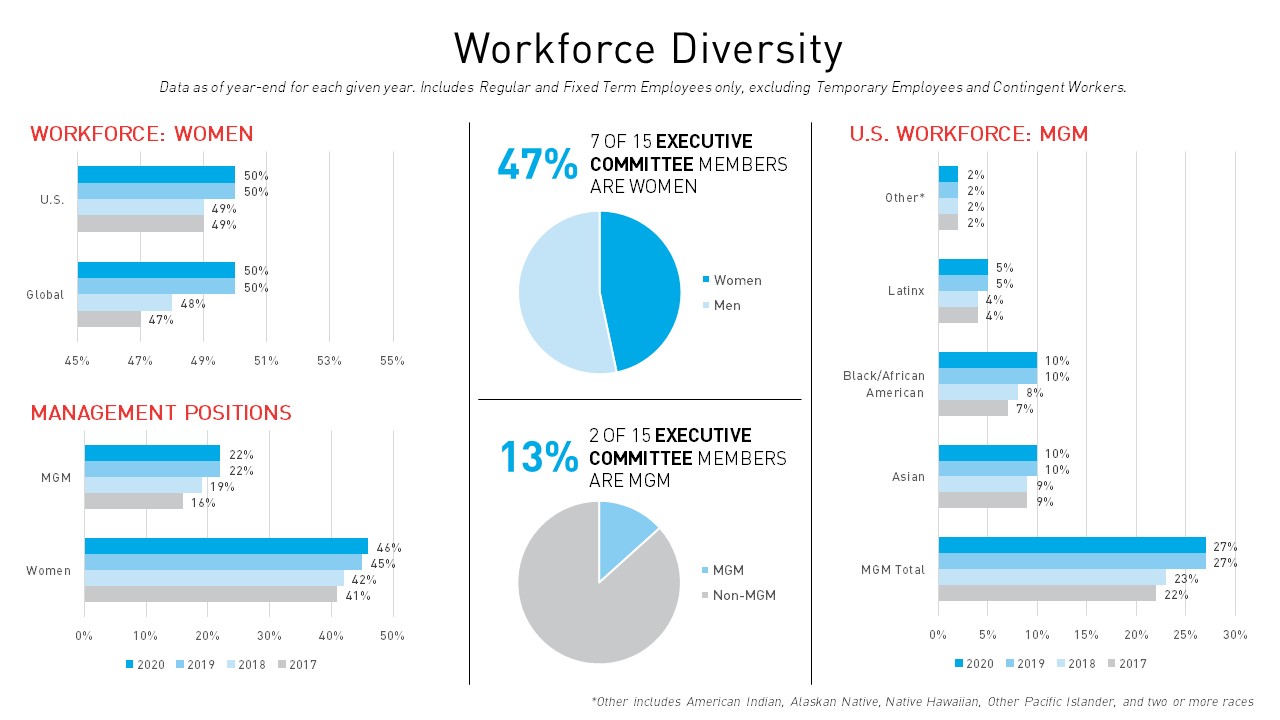

As part of our mission to improve lives around the world, we are committed to creating a safe, supportive, ethical, and rewarding work environment. Lilly’s core values of integrity, excellence, and respect for people and our dedication to diversity and inclusion are critical components of how we do business. We take a holistic approach because we’re a stronger company when we have a workforce of top talent from different backgrounds—people who are respected, valued, welcomed, and heard. To fulfill our purpose, we must look at challenges from multiple viewpoints and understand the diverse experiences of the patients who depend on us. In short, our differences make a difference—to patients and to our business.

Our board recognizes that one of its key responsibilities is to ensure that Lilly is governed in a manner that provides both independent oversight and efficient and effective decision-making. Our chief executive officer brings to the role of chairman of our board substantial strategic and operational perspectives and a unique understanding of Lilly's opportunities and challenges. This summary highlights information contained elsewherefamiliarity with our business, as well as extensive experience and leadership in our industry, position our chief executive officer to drive strategy and agenda-setting at the board level. Further, our lead independent director, currently chief executive officer of a Fortune 100 company, drives an "outside in" analysis of company decisions and performance, maintains frequent contact with our chairman to ensure a productive partnership between our independent directors and management, and leads our independent directors in their important oversight function.

Our board continues to prioritize meaningful engagement with our shareholders and other key stakeholders. Since our 2020 annual meeting of shareholders, we have spoken with a number of investors on an array of subjects, including board leadership; environmental, social, and governance topics; drug pricing transparency and global access to our products, including our COVID-19 therapies; product quality and safety; key enterprise risks; executive compensation; and human capital management. Given the significant challenges the world faced in 2020, we appreciate now more than ever the thoughtful and constructive feedback that we receive from our stakeholders. As a result of this proxy statement. It does not contain allinput, as in past years, the informationboard is putting forward management proposals at the Annual Meeting to eliminate the classified board structure and supermajority voting requirements in our articles of incorporation.

We remain committed to serving you should consider, and the millions of patients around the world whose lives it is our mission to make better. We look forward to welcoming you should readat the entire proxy statement carefully before voting.Annual Meeting.

Sincerely,

|  | |||||||||||||

| David A. Ricks | Juan Luciano | |||||||||||||

| Chairman, President, and CEO | Lead Independent Director | |||||||||||||

Table of Contents

P1 | ||||||

P3 | ||||||

P13 | ||||||

P13 | ||||||

P13 | ||||||

P25 | ||||||

P26 | ||||||

P28 | ||||||

P29 | ||||||

P30 | ||||||

P32 | ||||||

P32 | ||||||

P39 | ||||||

P39 | ||||||

P39 | ||||||

P40 | ||||||

P40 | ||||||

P41 | ||||||

P42 | ||||||

P42 | ||||||

P43 | ||||||

P45 | ||||||

P62 | ||||||

P73 | ||||||

P74 | ||||||

P74 | ||||||

P76 | ||||||

P76 | ||||||

P77 | ||||||

P78 | ||||||

P78 | ||||||

Item 7 - Proposal to Amend the Bylaws to Require an Independent Board Chair | P80 | |||||

P82 | ||||||

P84 | ||||||

P85 | ||||||

P85 | ||||||

P88 | ||||||

P89 | ||||||

P92 | ||||||

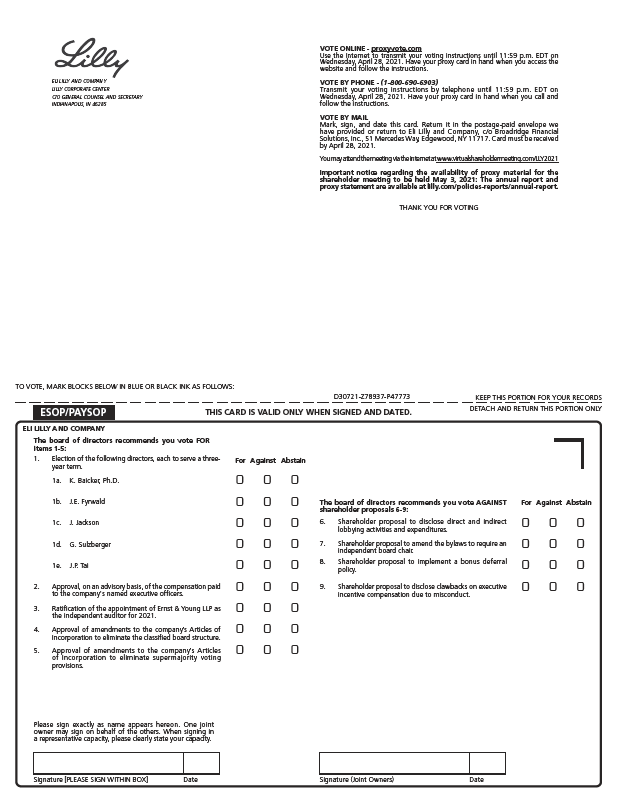

Notice of 2021 Annual Meeting of Shareholders

To the holders of common stock of Eli Lilly and Company:

The 2021 Annual Meeting of Shareholders (the Annual Meeting) of Eli Lilly and Company (referred to as Lilly, we, us, or the company in this proxy statement) will be held as shown below:

| TIME AND DATE | LOCATION | WHO CAN VOTE | ||||||

| 11:00 a.m. EDT, Monday, May 3, 2021 | Virtually at virtualshareholdermeeting.com/LLY2021 | |||||||

Due to concerns regarding the ongoing COVID-19 pandemic and to support the health and well-being of our employees, board of directors, shareholders, and other meeting participants, the Annual Meeting will be held virtually via live webcast. Although you will not be able to attend the Annual Meeting at a physical location, we have designed the Annual Meeting live webcast to provide shareholders the opportunity to participate virtually to facilitate shareholder attendance and to provide a consistent experience to all shareholders, regardless of location.

This proxy statement is dated March 19, 2021, and we mailed our shareholders of record as of February 22, 2021 (other than those who previously requested electronic or paper delivery of our proxy materials and certain participants in The Lilly Employee 401(k) plan (401(k) Plan)) a notice of internet availability of proxy materials on or about that date.

ITEMS OF BUSINESS

| Page Reference | ||||||||||||

Item 1 | Election of each of the five | FOR each of the director nominees | 13 | |||||||||

| Compensation | ||||||||||||

| Item 2 | Approval, | FOR | 42 | |||||||||

| Audit Matters | ||||||||||||

| Item 3 | Ratification of the appointment of Ernst & Young LLP as the | FOR | 74 | |||||||||

| Management Proposals | ||||||||||||

| Item 4 | FOR | 76 | ||||||||||

Item 5 | FOR | 77 | ||||||||||

| Shareholder Proposals | ||||||||||||

Item 6 | Shareholder proposal | AGAINST | 78 | |||||||||

Item 7 | Shareholder proposal | AGAINST | 80 | |||||||||

Item 8 | Shareholder proposal | AGAINST | 82 | |||||||||

| Shareholder proposal | AGAINST | 84 | ||||||||||

You will be able to attend the Annual Meeting, vote, and submit questions virtually via live webcast by visiting virtualshareholdermeeting.com/LLY2021. To be admitted to the Annual Meeting webcast, you must enter the 16-digit control number found on the proxy card, voting instruction form, or notice you received. You may vote during the Annual Meeting by following the instructions available on virtualshareholdermeeting.com/LLY2021during the Annual Meeting.

For further information on how to attend the Annual Meeting, see the section titled "Other Information—Meeting and Voting Logistics."

P1

Every shareholder vote is important. Even if you plan to attend the Annual Meeting, we encourage you to vote promptly online, by telephone, or, if you received or requested paper copies of your proxy materials, by signing, dating, and returning your proxy card or voting instructions by mail, so that a quorum may be represented at the meeting.

| By order of the Board of Directors, | |||||

| Ms. Anat Hakim | |||||

| Senior Vice President, General Counsel | |||||

| and Secretary | |||||

| March 19, 2021 | |||||

| Indianapolis, Indiana | |||||

P2

Proxy Statement Summary

New Inin This Year's Proxy Statement

In February 2017, we welcomed Carolyn R. Bertozziresponse to the board. Dr. Bertozzi isCOVID-19 pandemic, we focused in 2020 on maintaining a reliable supply of our medicines, reducing the Anne T.strain on the medical system, protecting the health, safety, and Robert M. Bass Professorwell-being of Chemistryour employees, supporting our communities, and Professorensuring affordability of Chemical and Systems Biologyaccess to our medicines, particularly insulin. In addition, we have been proud to mobilize our scientific and Radiology at Stanford University. She is an investigatormedical expertise to fight COVID-19. As of February 9, 2021, we have received three emergency use authorizations for our COVID-19 therapies, and we are working diligently to support affected patients, communities, and employees during these challenging times.

In addition, we have recently undertaken a comprehensive review of our human capital management initiatives, resources, and progress. In this proxy statement, you will find enhanced disclosure about our approach to human capital management, including diversity and inclusion (D&I), and our governance oversight of these topics. See "Governance—Highlights of the Howard Hughes Medical Institute. In May 2017, John LechleiterCompany’s Corporate Governance—Human Capital Management."

Effective January 25, 2021, Gabrielle Sulzberger was elected to the board as a member of the director class of 2021. Ms. Sulzberger was appointed to the Audit Committee and Franklyn Prendergast retiredthe Ethics and Compliance Committee. Effective February 16, 2021, Kimberly H. Johnson was elected to the board as a member of the director class of 2022. Ms. Johnson was appointed to the Compensation Committee and the Ethics and Compliance Committee. Kathi Seifert, who joined the board in 1995, will retire from the board following the Annual Meeting.

Effective January 1, 2021, our board disbanded the Finance Committee and on June 1, 2017, Dave Ricks succeeded John Lechleiterreorganized the Public Policy and Compliance Committee as Chairman.

capital allocation matters.

Further, as in past years, our board has approved, and recommends that theour shareholders approve, the followingtwo important management proposals at this meeting.the Annual Meeting. The board recommends approval of amendments to the company’s Articlesarticles of Incorporationincorporation to eliminate the classified board structure (see Item 4 herein) and to eliminate supermajority voting provisions (see Item 5 herein). The board believes these two proposals balance shareholder interests and demonstrate its accountability and willingness to take steps that address shareholder-expressed concerns. Lastly, the board recommends approval of the company’s amended and restated stock plan (see Item 6 herein). Stock incentive plans have been an integral part of the company’s compensation programsconcerns expressed by shareholders.

Highlights of 2017 Company2020 Performance

The following provides a brief look atoverview of our 20172020 performance in threefour dimensions: operating performance, progress in our innovation progress,pipeline, business development, and shareholder return.return, both absolute and relative. See our 2017 annual reportAnnual Report on Form 10-K for the fiscal year ended December 31, 2020 for more details.

We continued to progress our company's purpose and strategy in 2020 as we remained focused on:

•Discovering, acquiring, and developing first- or best-in-class medicines to address significant unmet needs in our core therapeutic areas—diabetes, oncology, immunology, neurodegeneration, and pain;

•Reaching patients who can benefit from our innovative medicines around the world, directly and through partnership with healthcare systems and collaborators, providing broad access to safe, life-changing medicines;

•Focusing our time and resources on new medicines that our customers value most, delivering volume-driven sustainable growth; and

•Reinvesting in our business and our people to discover new medicines to address unmet medical needs, improve cost productivity, reduce environmental impact and reliably supply quality medicines, while returning capital to shareholders.

We believe our strategic choices, coupled with robust execution, delivered significant value for shareholders and patients in 2020. We reached over 40 million patients globally with our medicines, expanded our patient support programs, achieved significant pipeline advancements and key data readouts across our core therapeutic areas, leveraged external innovation to expand our pipeline, and delivered high total shareholder returns relative to our peers and the S&P 500 index. The discussion below expands on our considerable success in 2020.

P3

Operating Performance

Performance highlights:

Reported results were prepared in accordance with U.S. generally accepted accounting principles (GAAP) and include all revenue and expenses recognized during the periods. A reconciliation of EPS on a reported basis to EPS on a non-GAAP basis to $4.28.

2020 Innovation and Business Development Progress

We made significant pipeline advances with our pipeline in 2017,2020, including:

• |

U.S. approval of expanded label for Trulicity® (dulaglutide) to include 3.0 mg and EU4.5 mg doses and an updated indication statement to include results from the REWIND™ cardiovascular outcomes trial;

•U.S. approval of Retevmo® (selpercatinib) for the treatment of metastatic non-small cell lung cancer in adult patients; for the treatment of advanced metastatic medullary thyroid cancer who require systemic therapy in adult and pediatric patients; and for the treatment of advanced metastatic thyroid cancer in adult and pediatric patients who require systemic therapy and are radioactive iodin-refractory;

•U.S. approval of Lyumjev® (insulin lispro-aabc), a rapid-acting human insulin analog for the treatment of diabetes;

•U.S. approval of new indications for Taltz® (ixekizumab) for the treatment of adultsactive non-radiographic axial spondyloarthritis (nr-axSpA) and for the treatment of pediatric patients with active psoriatic arthritismoderate to severe plaque psoriasis;

•.U.S. approval of Tauvid™ (flortaucipir F 18 injection), a radioactive diagnostic agent, for positron emission tomography imaging of the brain to estimate the density and distribution of aggregated tau neurofibrillary tangles in patients with cognitive impairment who are being evaluated for Alzheimer's disease;

•U.S. approval of a new indication for Cyramza® (ramucirumab) in combination with erlotinib for the first-line treatment of people with metastatic non-small cell lung cancer; and

We announced several key data readouts in 2020, including:

•positive top-line results from SURPASS-1, a Phase III monotherapy study evaluating the efficacy and rheumatoid arthritis, respectively. Olumiant is partsafety of the company’s collaboration with Incyte.

•positive results from a pre-planned interim analysis of monarchE, a Phase III study of Verzenio® (abemaciclib) in combination with standard adjuvant endocrine therapy for early breast cancer. The study met the U.S.primary endpoint of invasive disease-free survival, significantly decreasing the risk of breast cancer recurrence or death compared to standard adjuvant ET alone; and

•updated data from the LOXO-305 BRUIN Phase I/II clinical trial in mantle cell lymphoma and other non-Hodgkin lymphomas, as well as in chronic lymphocytic leukemia and small lymphocytic lymphoma, at the 2020 American Society of Hematology Annual Meeting.

We also completed multiple significant strategic acquisitions, license agreements, and research collaborations to strengthen our pipeline in 2020, including:

•acquisition of Dermira, Inc. to expand Lilly's immunology pipeline with the addition of lebrikizumab, which is being evaluated in a Phase III clinical development program for migrainethe treatment of moderate to severe atopic dermatitis;

•acquisition of Disarm Therapeutics, Inc., a privately held biotechnology company creating a new class of disease-modifying therapeutics for patients with axonal degeneration; and

•participated in, and made a $100 million commitment to, the AMR Action Fund, a $1 billion initiative from more than 20 biopharmaceutical companies to address the urgent need for new antibiotics to combat antimicrobial resistance.

P4

Given the global COVID-19 pandemic, we also redirected our resources and made significant advancements in COVID-19 therapies in 2020, including:

•in collaboration with AbCellera Biologics Inc. (AbCellera), received emergency use authorization from the FDA for bamlanivimab in higher-risk patients who have been recently diagnosed with mild-to-moderate COVID-19;

•in collaboration with Incyte Corporation, received emergency use authorization from the FDA for baricitinib in combination with remdesivir for patients with COVID-19 infection;

•entered into an agreement with Junshi Biosciences Co., Ltd. to co-develop therapeutic antibodies for the potential prevention and resubmissiontreatment of baricitinib inCOVID-19, including etesevimab, the U.S.lead antibody from the collaboration;

•entered into a global antibody manufacturing collaboration with Amgen Inc. to significantly increase the supply capacity available for rheumatoid arthritis.Lilly's potential COVID-19 therapies; and

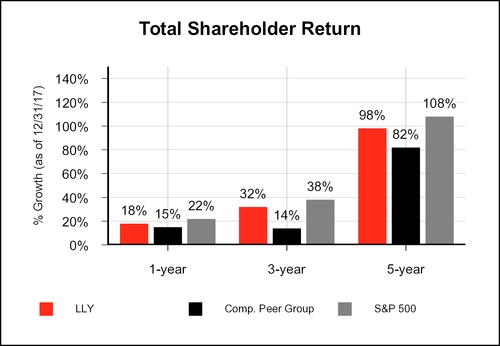

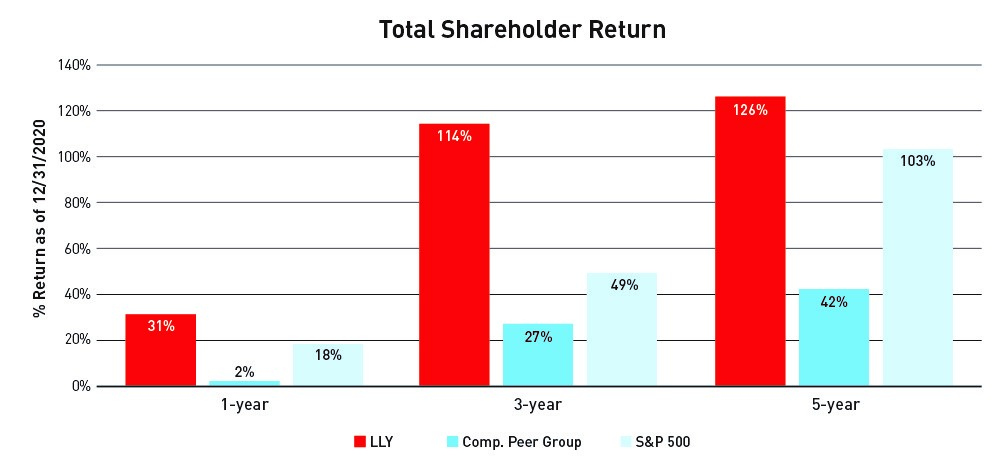

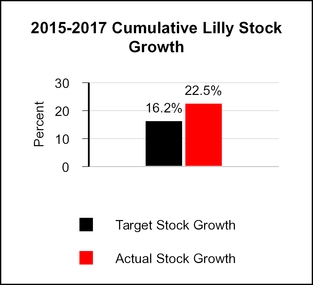

Shareholder ReturnReturns

We generated strong total shareholder returns (share(TSR) through December 31, 2020. Our TSR takes into account both share price appreciation plusand dividends. Any dividends paid by a given company are assumed to be reinvested quarterly) through year-end 2017.in that company’s stock on a quarterly basis. Our returns significantly exceeded theour compensation peer group but slightly laggedand the S&P 500 acrossduring the timethree- and five-year periods presented below:

Our Response to COVID-19

As discussed in "Proxy Statement Summary—Highlights of 2020 Performance—2020 Innovation and Business Development Progress," we have made significant advancements in developing potential therapies for COVID-19, including making available the first therapy designed for COVID-19 under an emergency use authorization, and we continue our research and development efforts and our partnership with regulators and governments to bring COVID-19 treatments to patients. In addition to dedicating substantial resources to these efforts, we have prioritized maintaining a reliable supply of and access to our medicines, particularly insulin, reducing the strain on the medical system, protecting the health, safety, and well-being of our employees, and supporting our workforce, affected communities, and patients who need our medicines.

Maintaining Supplies of and Access to Lilly Medicines

Throughout 2020, we took important steps to protect our manufacturing processes and remained in close communication with key suppliers regarding supplies of raw materials. As a result of our efforts, we were largely able to maintain our normal operations in 2020 and we maintained a steady supply of medicines on which millions of patients rely. We also initiated patient support programs to ensure patients maintained affordable access to their medications, and adjusted how we operate to offer innovative solutions to our customers. We remain committed to working with stakeholders in healthcare systems to help patients get the medicines they need. Specific examples include:

P5

•launched the Insulin Value Program, allowing anyone with commercial insurance and those without insurance to fill their monthly prescription of Lilly insulin for $35; and

•established partnerships with leading diabetes technology companies to integrate their technologies into the solutions we are creating to improve diabetes management.

As a result of the pandemic, we have also accelerated changes to further utilize digital capabilities to run our business efficiently and effectively in a virtual environment. These include decentralizing clinical trials with virtual and more digitally-enabled studies, which could provide increased access to more diverse patient populations. We have also changed our go-to-market strategies, including leveraging omnichannel capabilities and virtual healthcare provider engagement. Although reduced in-person interactions by patients and our employees with the healthcare system has resulted, and may continue to result, in decreased demand for our products, we believe our approach is the appropriate posture as we support healthcare professionals navigating the ongoing COVID-19 pandemic and driving broad vaccination efforts.

Keeping Our Employees Safe and Healthy

While we have consistently focused on protecting the health and safety of our employees, the COVID-19 pandemic has emphasized the importance of this critical priority. In response to the pandemic, we have taken measures to protect our workforce, maximize social distancing, and inform employees about our policies. For example, we instituted travel restrictions and remote working arrangements for employees whose roles do not require on-site presence.

To support employee well-being in the U.S., we enhanced local benefits related to health care, childcare, and time off, and expanded reimbursement for home office ergonomic support expenditures. In the U.S., we provide full coverage for COVID-19 diagnostic testing and treatment, and at our corporate headquarters in Indianapolis, we provide free on-site testing for employees. In addition, as part of our Make it Safe to Thrive program, we partnered with our employee resource groups to offer a series of programs highlighting and addressing challenges faced by ERG members during the COVID-19 pandemic, aiming to build understanding of different experiences and to offer ways to be inclusive.

Supporting Our Communities

To support communities affected by the COVID-19 pandemic, we repurposed specialized labs to conduct free diagnostic testing in our home community of Indianapolis, and we created a drive-through testing facility at our corporate headquarters for essential workers, including healthcare workers and first responders, as well as employees. Lilly’s labs tested samples from more than 90,000 people collected around the state and at the Lilly drive-through facility. Together with the governor of Indiana, the mayor of Indianapolis and other community stakeholders, we launched the #INThisTogether community awareness campaign to provide access to helpful information and to encourage a community-wide commitment to reducing COVID-19 infections.

P6

Governance

| Name, age* and principal occupation | Public boards | Management recommendation | Vote required to pass | |||||||||||||||||

| Katherine Baicker, Ph.D., | HMS Holdings Corp. | Vote FOR | Majority of votes cast | ||||||||||||||||

| Dean and Professor, Harris School of Public Policy, University of Chicago | ||||||||||||||||||||

| Director since 2011 | ||||||||||||||||||||

| J. Erik Fyrwald, | Bunge Limited | Vote FOR | Majority of votes cast | ||||||||||||||||

| President and Chief Executive Officer, Syngenta | ||||||||||||||||||||

| Director since 2005 | ||||||||||||||||||||

| Jamere Jackson, 52 | Hibbett Sports, Inc. | Vote FOR | Majority of votes cast | ||||||||||||||||

Executive Vice President and Chief Financial Officer, | ||||||||||||||||||||

| Director since 2016 | ||||||||||||||||||||

| Brixmor Property Group Inc.; Cerevel Therapeutics Holdings, Inc. | Vote FOR | Majority of votes cast | |||||||||||||||||

| Director since | 2021 | |||||||||||||||||||

| Jackson P. Tai, | HSBC Holdings plc | Vote FOR | Majority of votes cast | ||||||||||||||||

| Former Vice Chairman and Chief Executive Officer, DBS Group Holdings | ||||||||||||||||||||

| Director since 2013 | ||||||||||||||||||||

| *Age is as of the date of this proxy statement. | ||||||||||||||||||||

Our Corporate Governance Policies Reflect Best Practices

ü Our board actively oversees and approves our corporate strategy.

ü Our board and board committee agendas are structured to engage our directors in informed reviews of strategic and forward-looking issues, as well as in constructive challenges to management initiatives and programs.

üOur board oversees the state of our compliance program and reviews our enterprise-level risks, including related to cybersecurity; our Audit Committee oversees our enterprise risk management processes and policies.

üWe have a comprehensive code of ethical and legal business conduct that applies to our board and all employees worldwide. This code is reviewed and approved annually by the board.

üWe have a supplemental code for our CEO and all members of financial management, in recognition of their unique responsibilities to ensure proper accounting, financial reporting, internal controls, and financial stewardship.

P7

üThe charters of our board committees clearly establish the committees’ respective roles and responsibilities.

üWe have an annual cap on director compensation.

Board skills and experience

üOur board membership is characterized by leadership, experience, and diversity.

üWe conduct comprehensive orientation and continuing education programs for directors.

üOur board conducts a robust annual assessment of board performance led by the lead independent director, including an annual assessment of each individual director.

üWe are committed to board refreshment and seek to balance continuity and fresh perspectives. Our director composition reflects a mix of tenure on the board. Currently, eight directors have served on the board for six years or more and seven directors have served on the board for five years or less.

Focus on independence

üEach of our current board members other than the CEO is independent (14 of our 15 directors as of the date of this proxy statement).

üWe have a strong lead independent director empowered with clearly defined responsibilities.

üAll standing board committees are composed solely of independent directors and led by independent committee chairs.

üOur board holds executive sessions of the independent directors at every regular board meeting that is presided over by our lead independent director.

üOur independent directors actively engage in board meetings, have direct access to management, and, along with our board committees, have discretion to hire independent advisors at the company’s expense.

üOur independent directors lead the board’s process for selecting the CEO.

üOur Compensation Committee (and, in the case of our CEO, in consultation with other independent directors and our external compensation consultant) establishes the compensation for our CEO and other executive officers.

üOur conflict of interest policy requires disclosures of potential conflicts to Lilly and clarifies when Lilly board service must be disclosed to others.

Governance and accountability to shareholders

üOur board values active shareholder engagement. In response to input from our shareholders, we have put forward for consideration at the Annual Meeting management proposals to eliminate the classified board structure and supermajority voting provisions in our articles of incorporation.

üIn 2019, the board amended our bylaws to add proxy access rights for shareholders holding at least three percent of our common stock for at least three years to nominate to the board the greater of two directors or 20 percent of our board seats.

üWe have a majority voting standard and resignation policy for the election of directors in uncontested elections.

üWe do not have a shareholder rights plan ("poison pill").

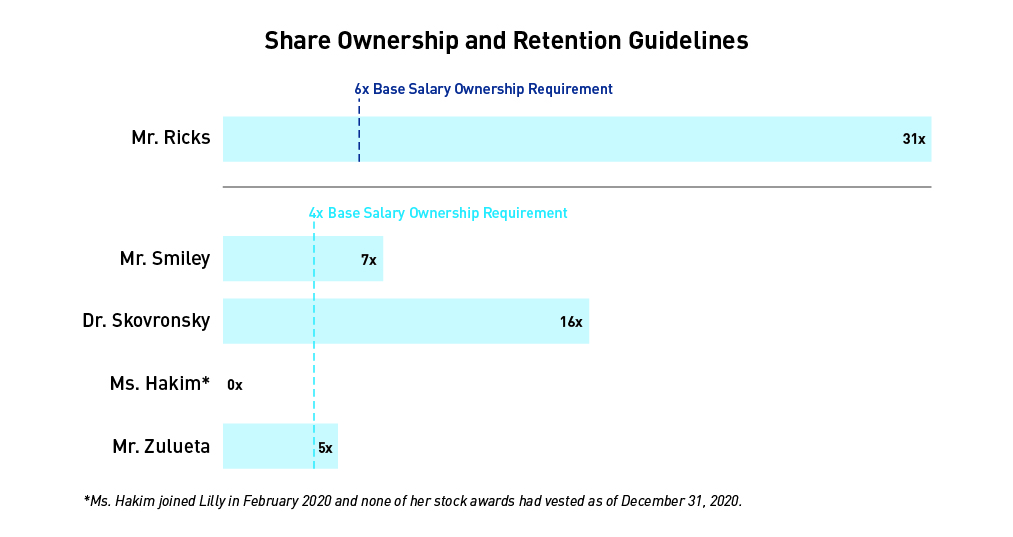

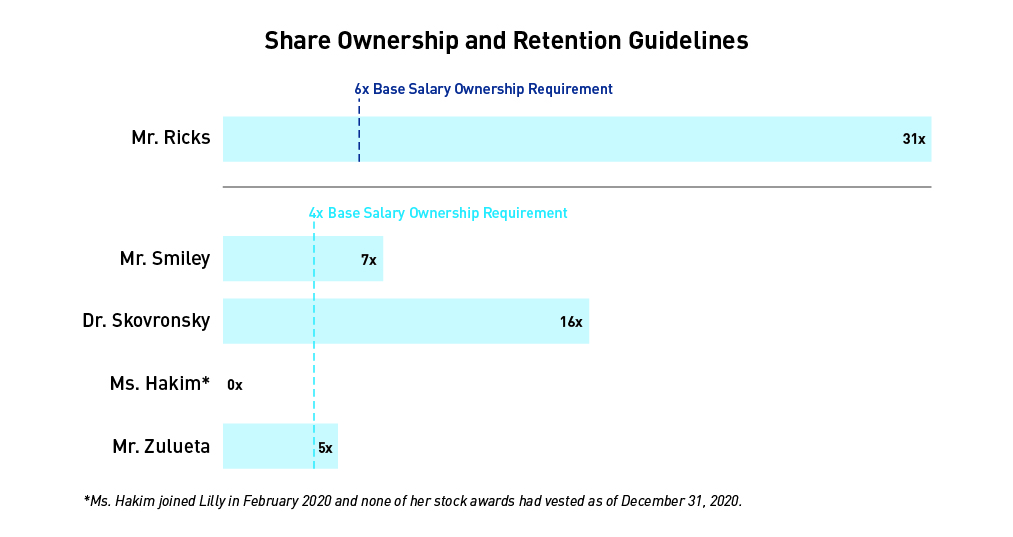

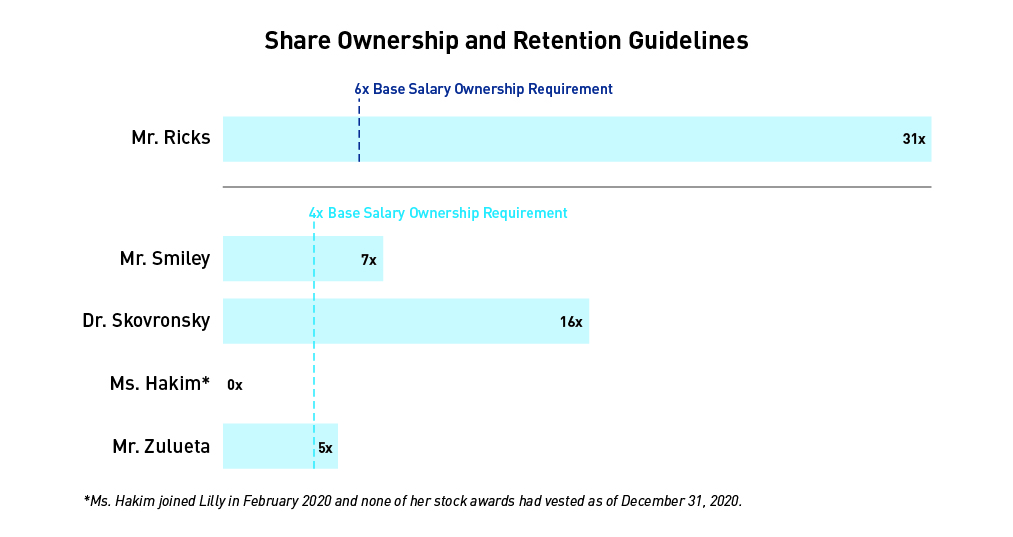

üWe have meaningful stock ownership and retention guidelines for our directors and executive officers to foster alignment with shareholders.

Sustainability

üOur board has a longstanding commitment to corporate responsibility.

ü We have strong governance and disclosure of corporate political spending.

ü We have transparent public policy engagement.

ü We have meaningful stock ownership guidelines forOur board oversees and maintains ongoing engagement with our directorsCompensation Committee, Directors and executive officers.Corporate Governance Committee, and senior executives on key political, social, and governance matters, including sustainability and human capital management.

üWe publish annual reports describing our sustainability efforts across key focus areas and we are engaged in a project to enhance our environmental, social, and governance sustainability reporting in 2021.

Item 2: Advisory Vote on Compensation Paid to Named Executive Officers For further information, see page 42 | Management recommendation Vote FOR | Vote required to pass | ||||||||||

| Majority of votes cast | ||||||||||||

P8

Our Executive Compensation Programs Reflect Best Practices

üShareholders strongly support our compensation practices: for the last five years, approximately 97 percent or more of shares cast voted in favor of our executive compensation programs.

üOur Compensation Committee annually reviews our compensation programs to ensure they provide incentives to deliver long-term, sustainable business results while discouraging excessive risk-taking and other adverse behaviors.

üWe have a broad compensation recovery or "clawback" policy that applies to all executives and covers a wide range of misconduct.

üOur executive officers are subject to robust stock ownership and retention guidelines and are prohibited from hedging or pledging their company stock.

üWe do not have "top hat" retirement plans. Supplemental plans are open to all employees and are limited to restoring benefits lost due to IRS limits on qualified plans.

üWe do not provide tax gross-ups to executive officers (except for limited gross-ups related to international assignments).

üWe have a very restrictive policy on perquisites.

üOur severance plans related to change-in-control require a double trigger.

üWe do not have employment agreements with any of our executive officers.

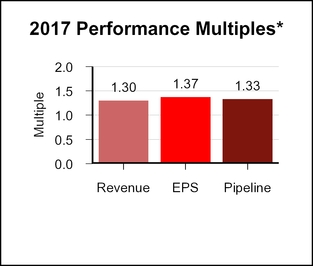

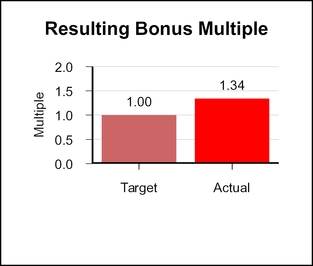

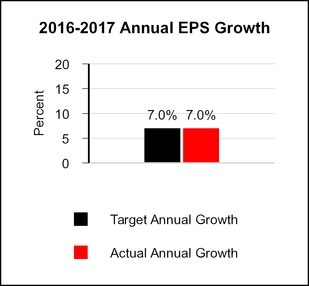

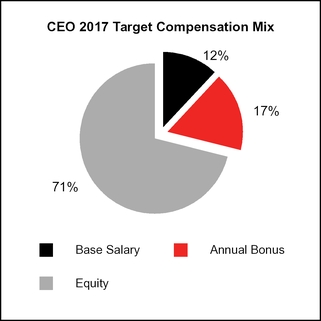

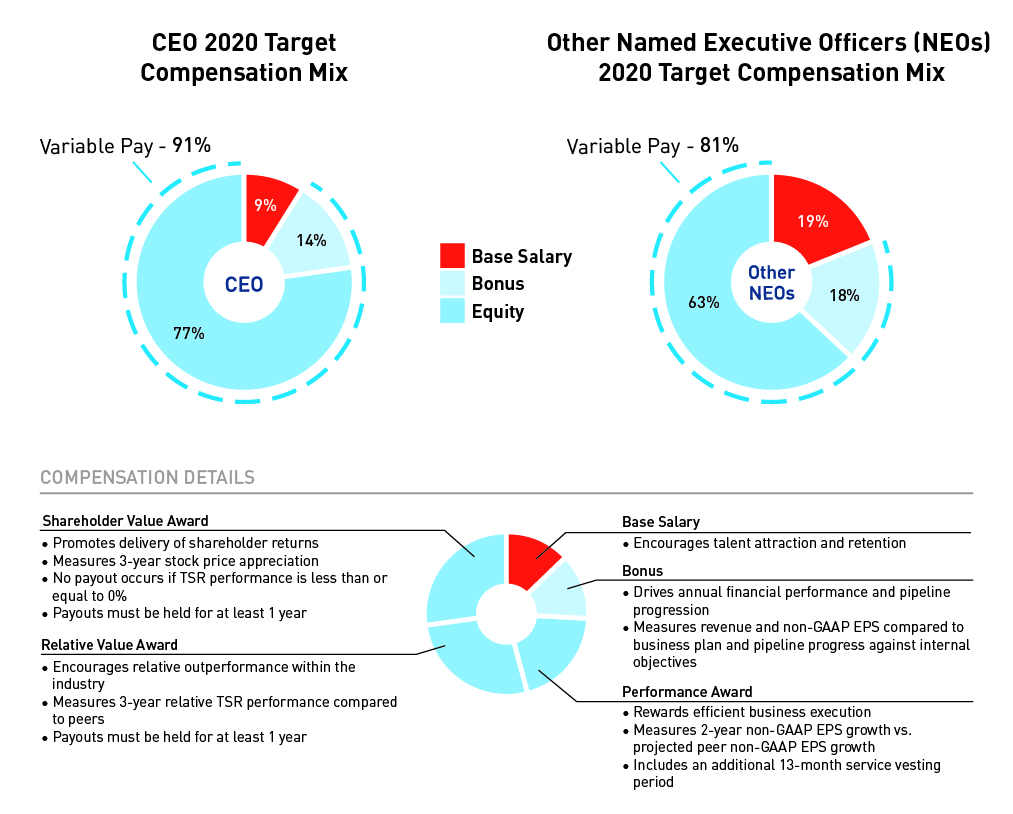

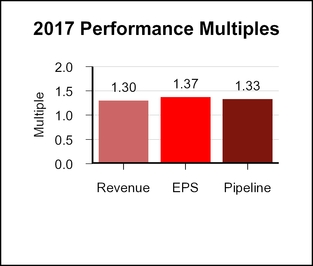

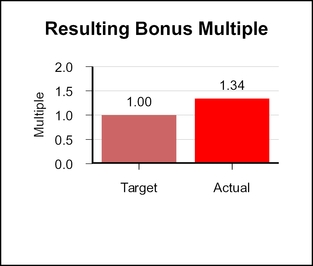

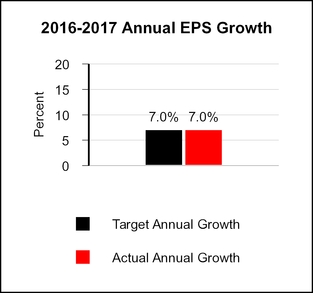

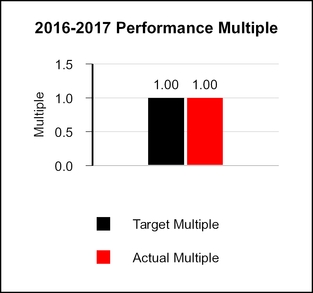

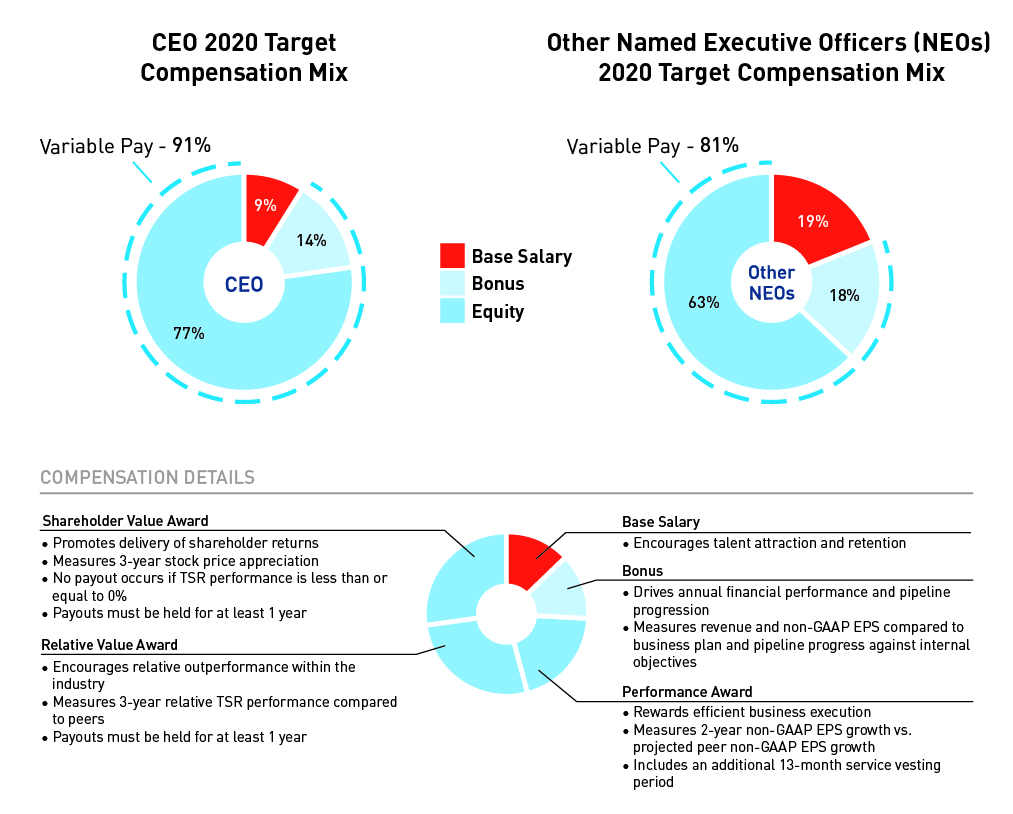

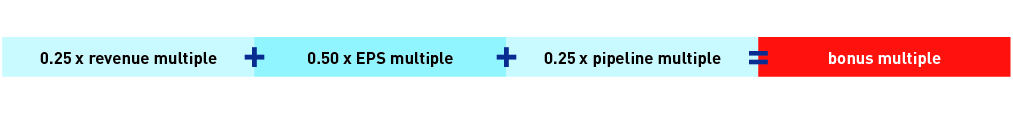

Executive Compensation Summary for 20172020

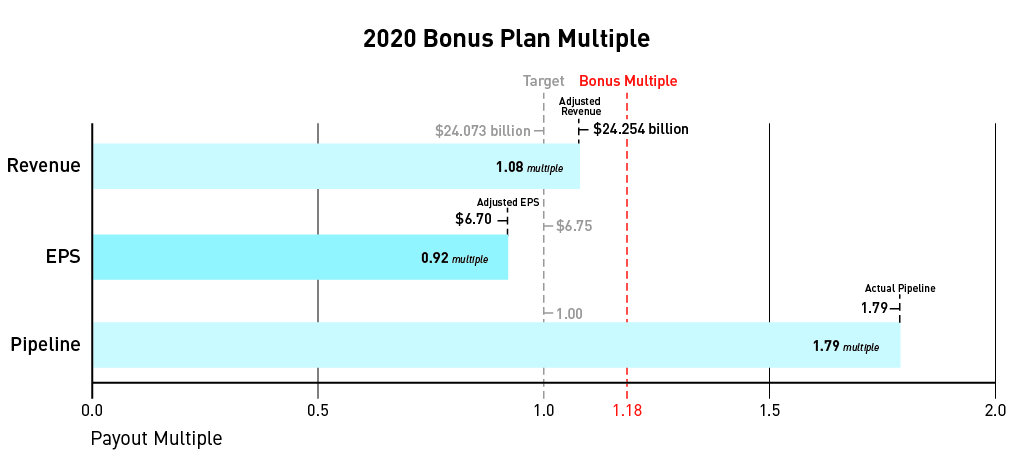

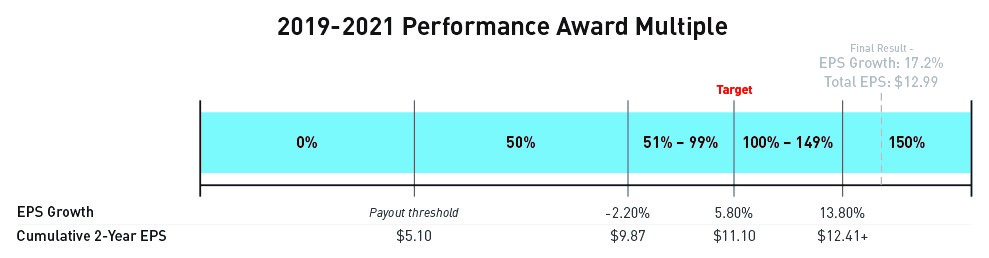

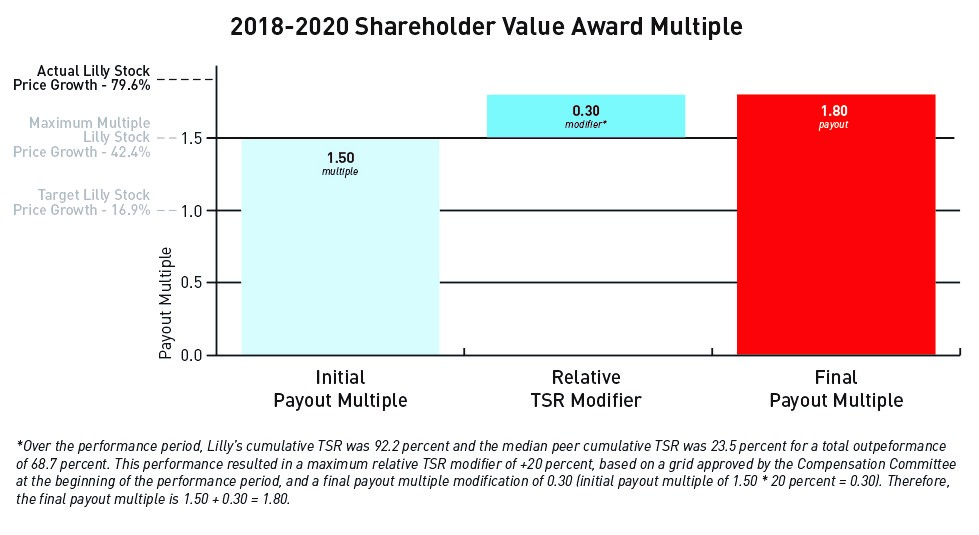

At the time the total target compensation was established at the end of 2016,2019, the target compensation in aggregate for our named executive officers (the five officers whose compensation is disclosed in this proxy statement) was in the middle rangeslightly below median of the company's peer group. Incentive compensation programs paid at or abovepayouts exceeded target, consistent with strong company performance over the company's strongbonus and equity performance in 2017.periods.

Pay for Performance

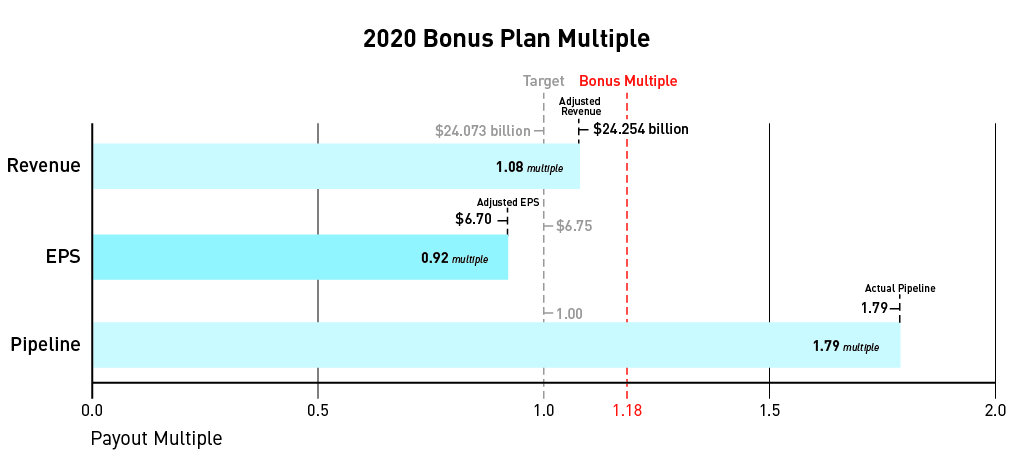

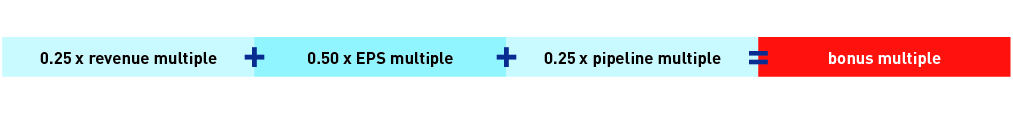

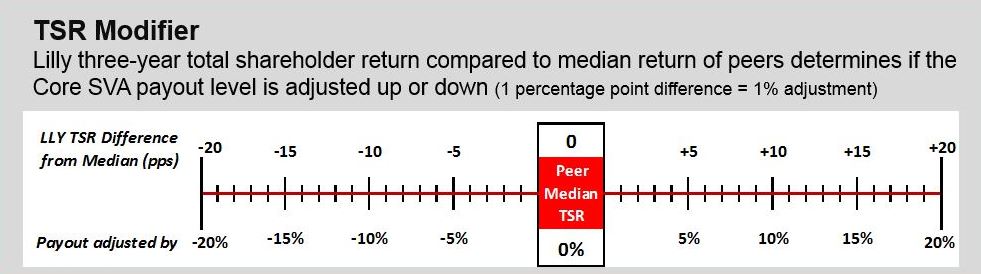

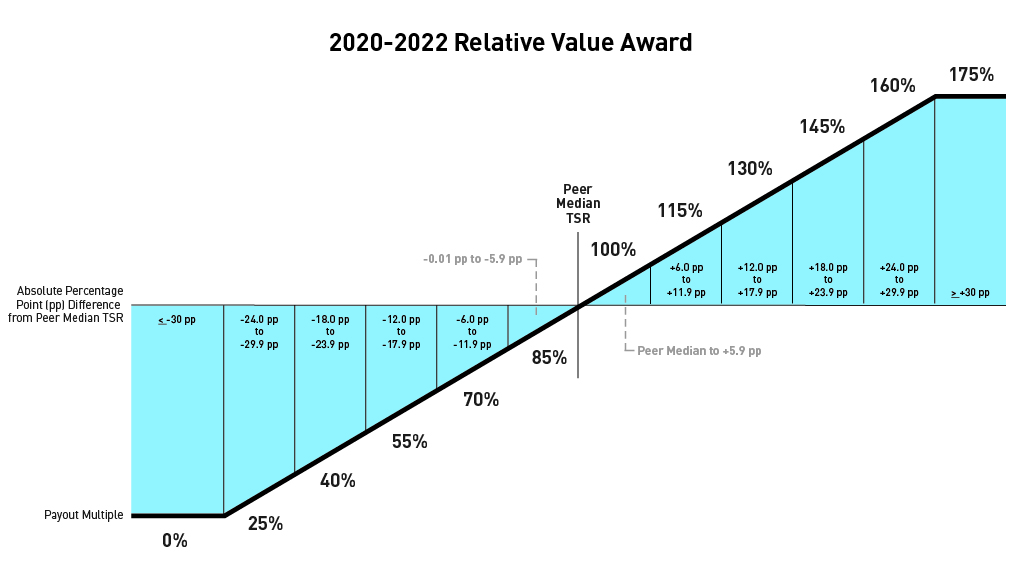

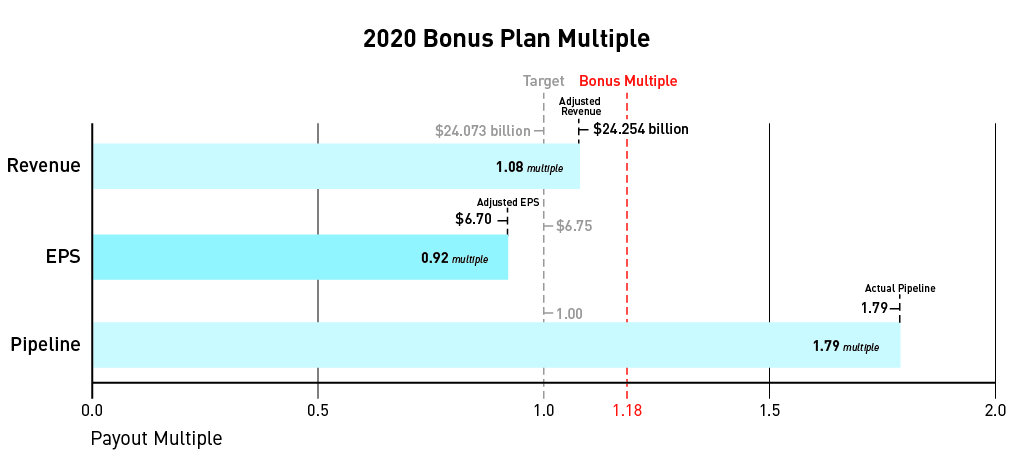

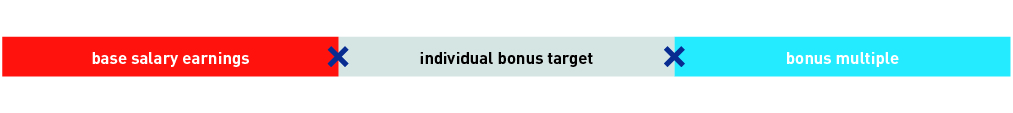

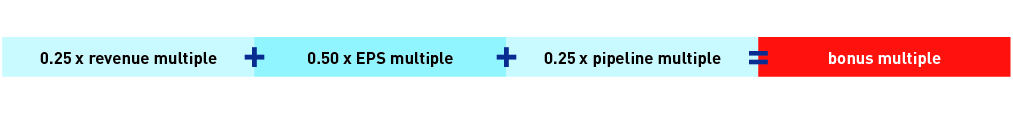

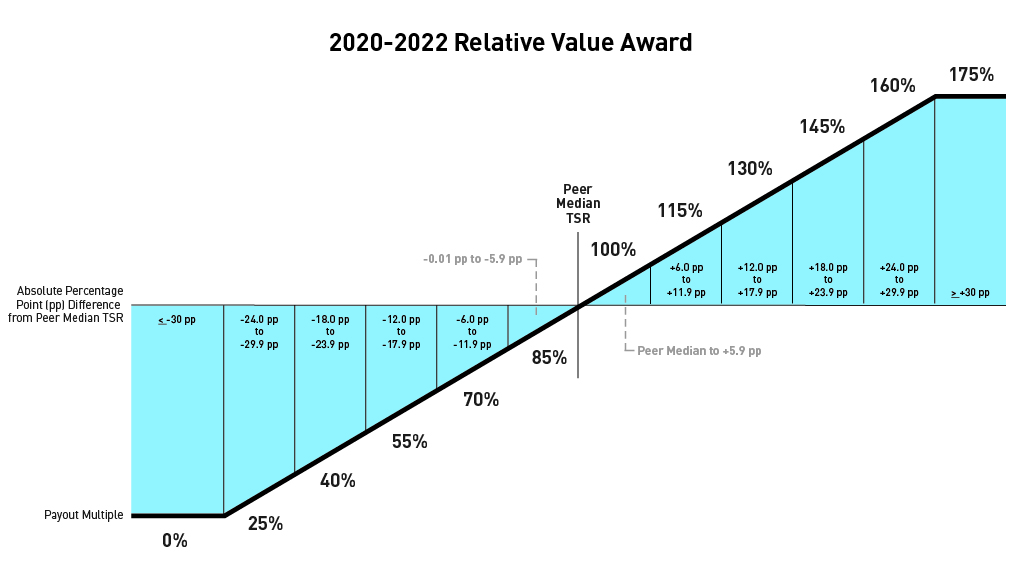

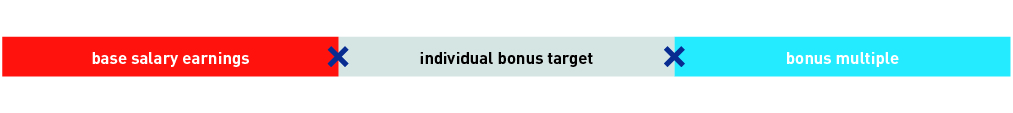

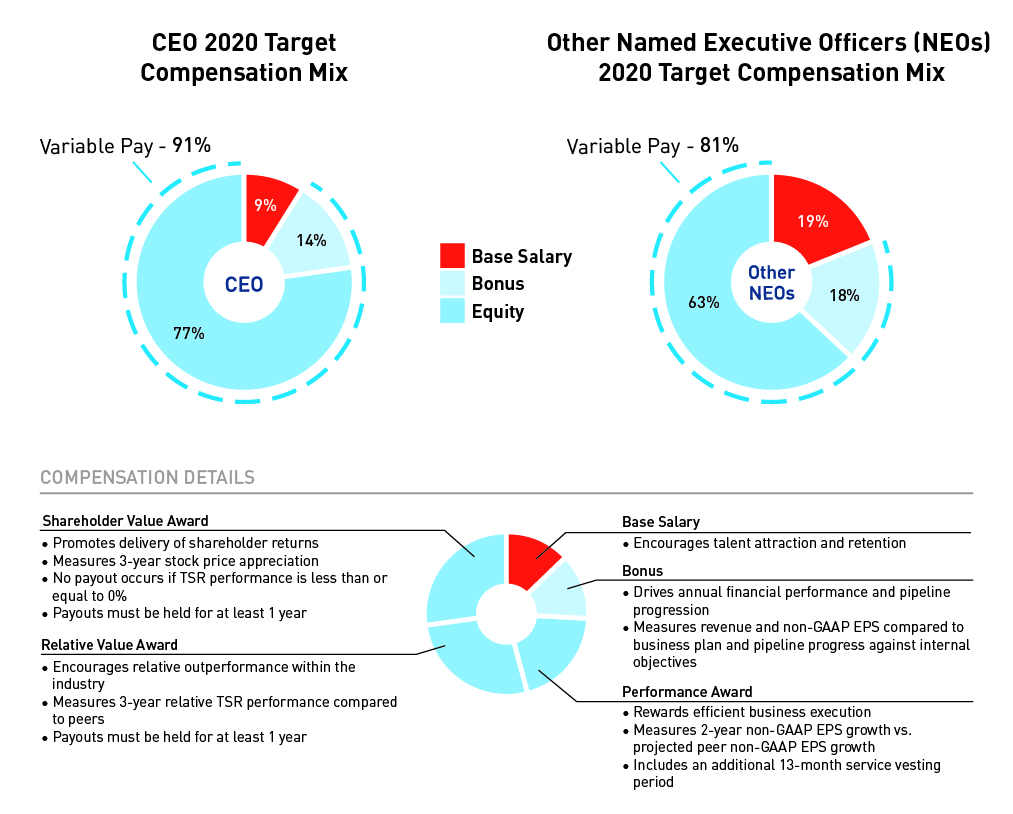

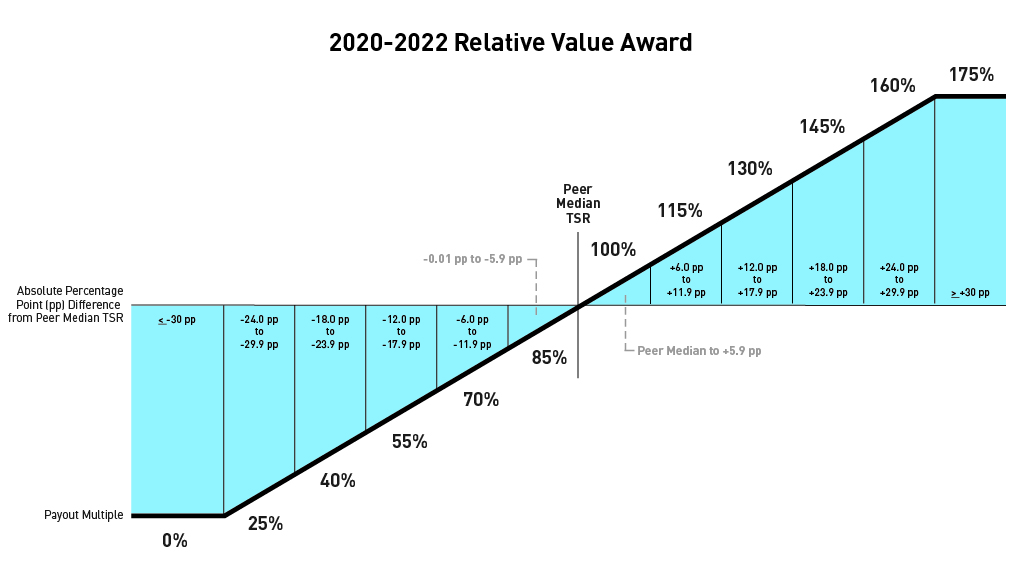

As described in the Compensation DisclosuresDiscussion and Analysis (CD&A), we link our incentive pay programs to a balanced mix of measures on three dimensions of company performance: operating performance; progress with our innovation pipeline; and shareholder return (both absolute and relative). The Compensation Committee adjusts reported EPS results to eliminate the distorting effect of certain unusual items on incentive compensation performance measures.

The summary below highlights how our incentive pay programs are intended to align with company performance. Please also see Appendix A for adjustments that were made to revenue and EPS for incentive compensation programs.

P9

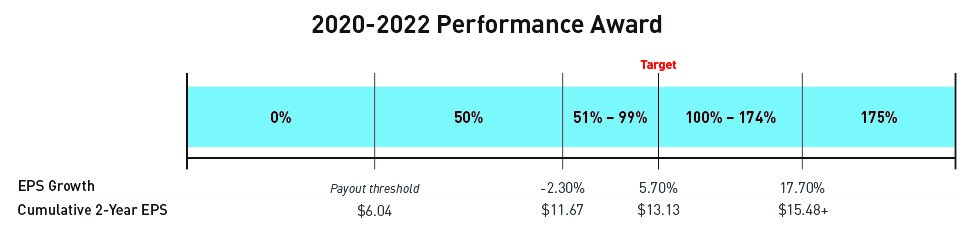

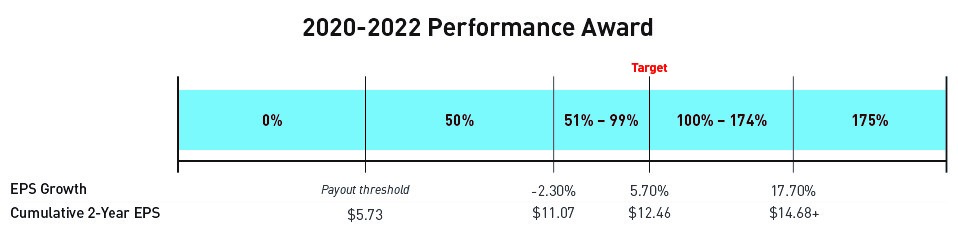

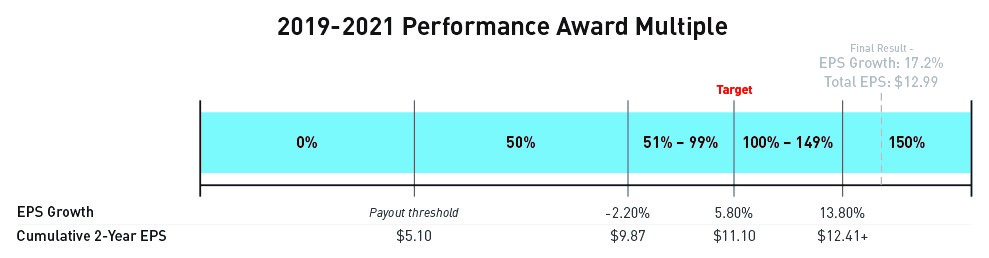

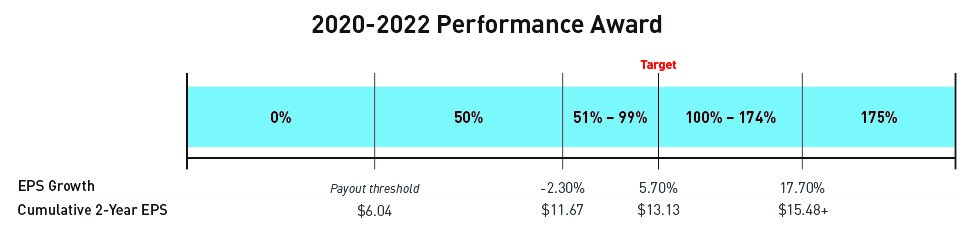

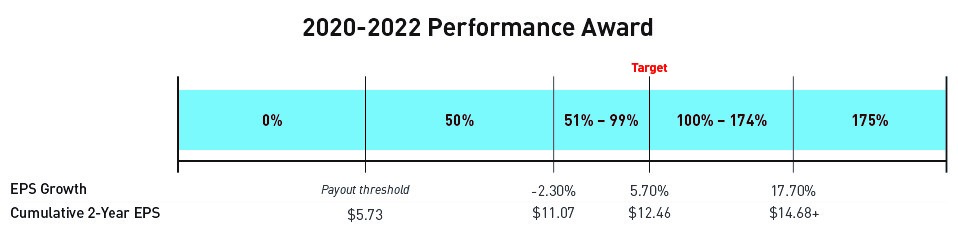

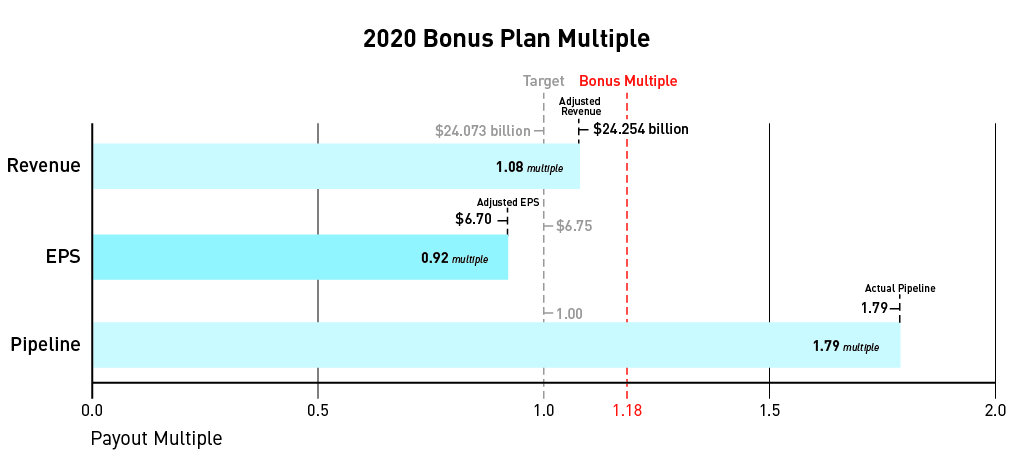

2020 Bonus Plan Multiple

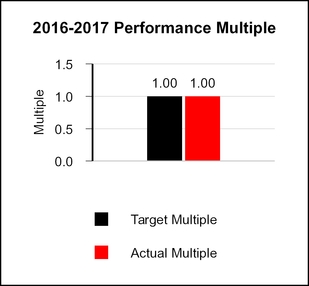

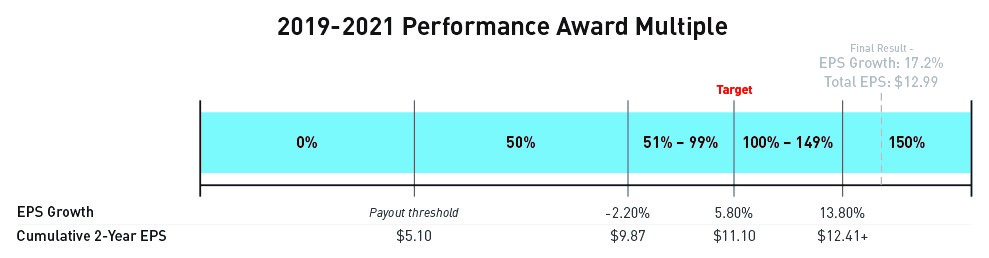

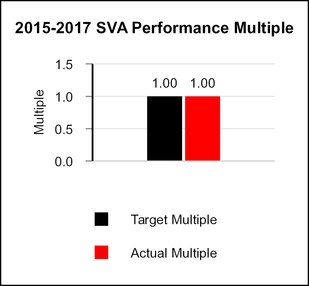

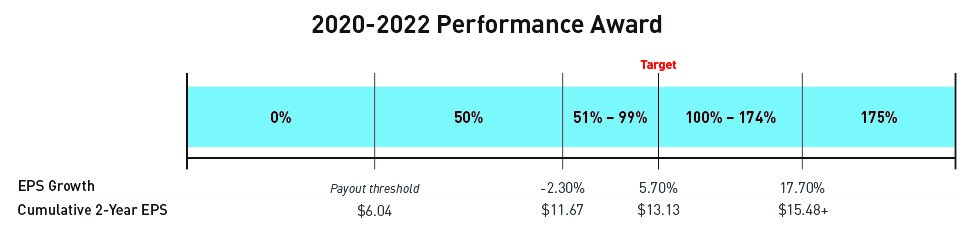

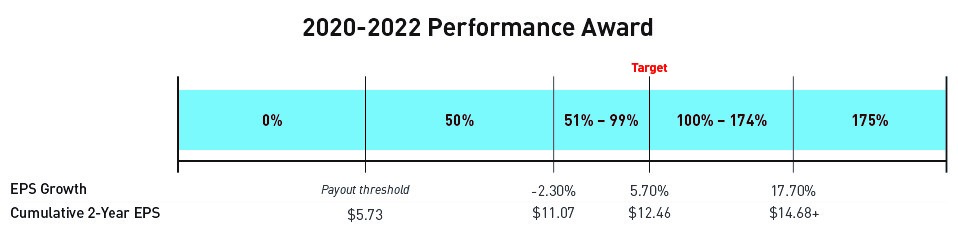

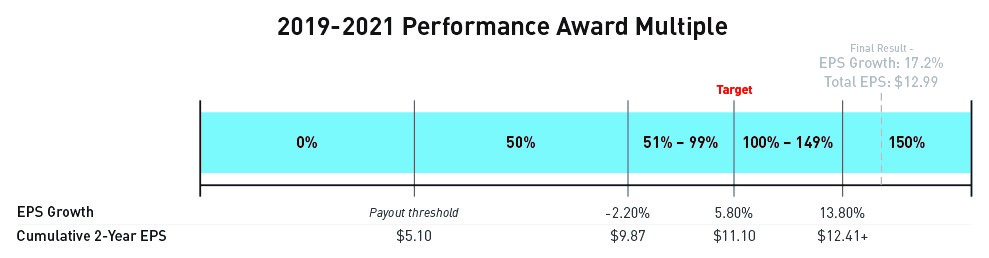

We metexceeded the EPS growth targets under our Performance Awardperformance award program, which has targets based on expected EPS growth of peer companies over a two-year period. For purposes of the performance award, the Compensation Committee adjusted non-GAAP EPS by $0.98 to exclude net gains on investments in equity securities that significantly exceeded business plan. This performance resulted in a Performance Awardperformance award payout atabove target. See the CD&A for further discussion on the performance award program.

P10

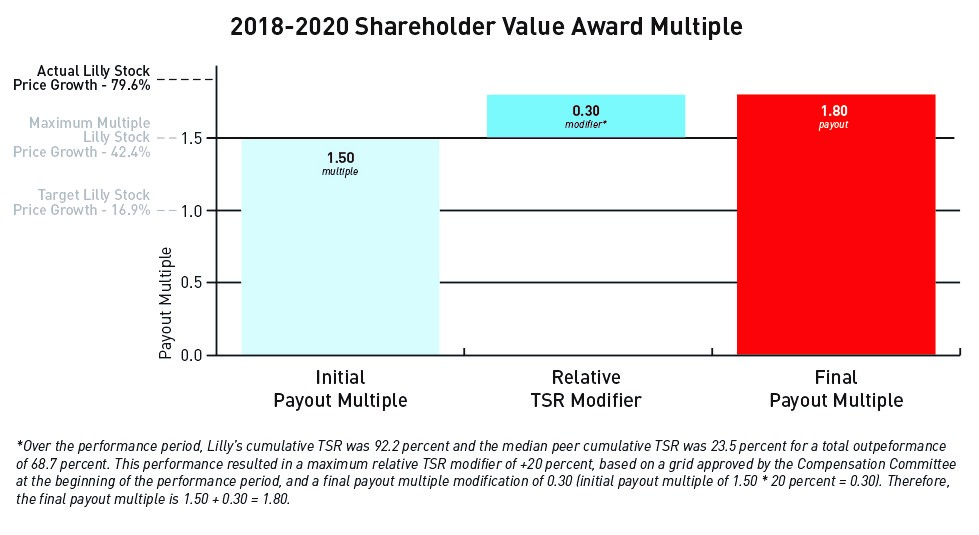

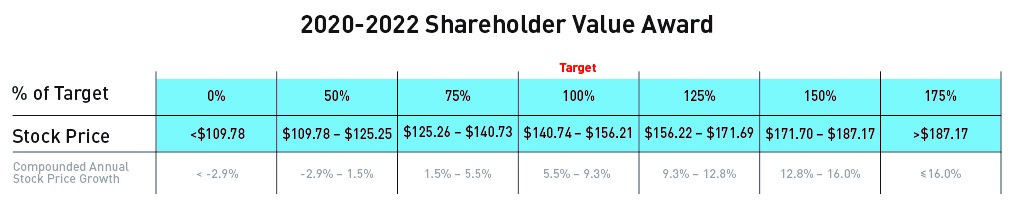

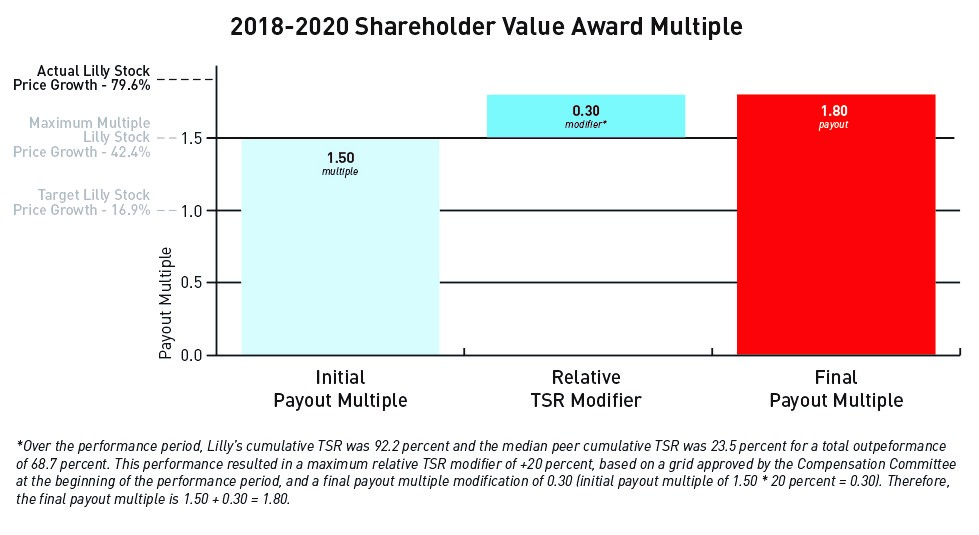

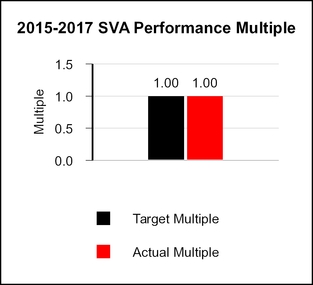

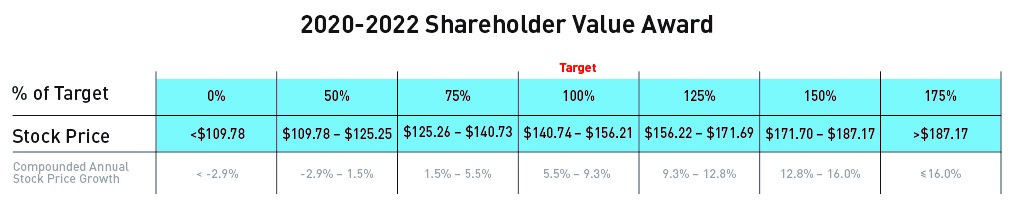

2018-2020 Shareholder Value Award Multiple

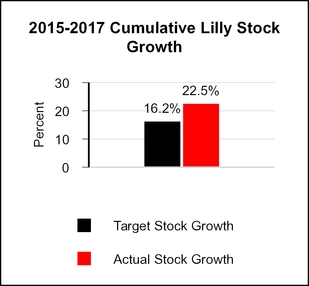

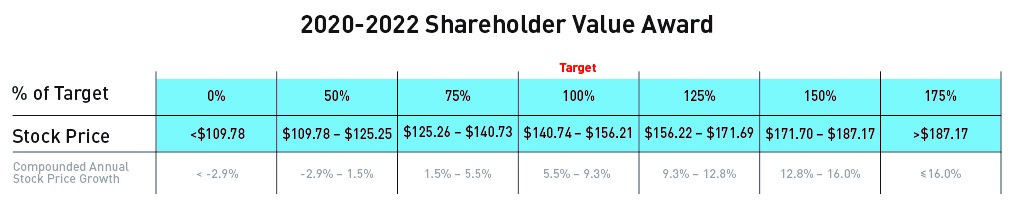

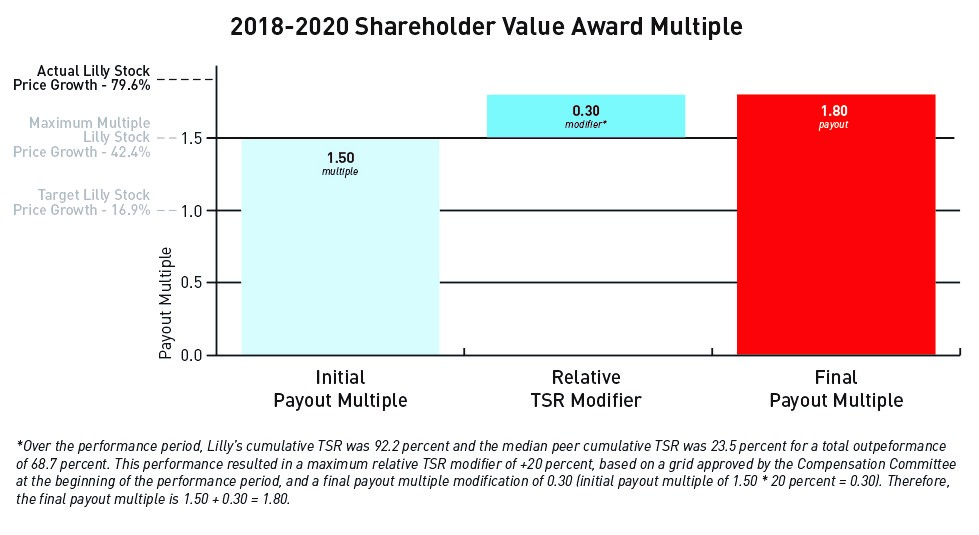

Our stock price growth was inexceeded the target range (16.2%(16.9 percent to 26.6%)29.7 percent) under our Shareholder Value Awardshareholder value award program, which is based on expected large-cap company returns over a three-year period. This performance resulted in a Shareholder Value Awardshareholder value award payout atabove target.

Audit Matters

Item 3: Ratification of the Appointment of the Independent Auditor For further information, see page74 | Management recommendation Vote FOR | Vote required to pass | ||||||||||

votes cast | ||||||||||||

Management Proposals

Item 4: Proposal to Amend the Company's Articles of Incorporation to Eliminate the Classified Board Structure For further information, see page 76 | Management recommendation Vote FOR | Vote required to pass | ||||||||||

80% of outstanding shares | ||||||||||||

Item 5: Proposal to Amend the Company's Articles of Incorporation to Eliminate Supermajority Voting Provisions For further information, see page 77 | Management recommendation Vote FOR | Vote required to pass | ||||||||||

| 80% of outstanding shares | ||||||||||||

P11

Shareholder Proposals

Item 6: Proposal to Disclose Direct and Indirect Lobbying Activities and Expenditures For further information, see page 78 | Management recommendation Vote AGAINST | Vote required to pass Majority of votes cast | ||||||||||

Item 7: Proposal to Amend the Bylaws to Require an Independent Board Chair For further information, see page 80 | Management recommendation Vote AGAINST | Vote required to pass Majority of votes cast | ||||||||||

Item 8: Proposal to Implement a Bonus Deferral Policy For further information, see page 82 | Management recommendation Vote AGAINST | Vote required to pass Majority of votes cast | ||||||||||

Item 9: Proposal to Disclose Clawbacks on Executive Incentive Compensation Due to Misconduct For further information, see page 84 | Management recommendation Vote AGAINST | Vote required to pass | ||||||||||

Majority of votes cast | ||||||||||||

Voting

How to Vote in Advance of the Meeting

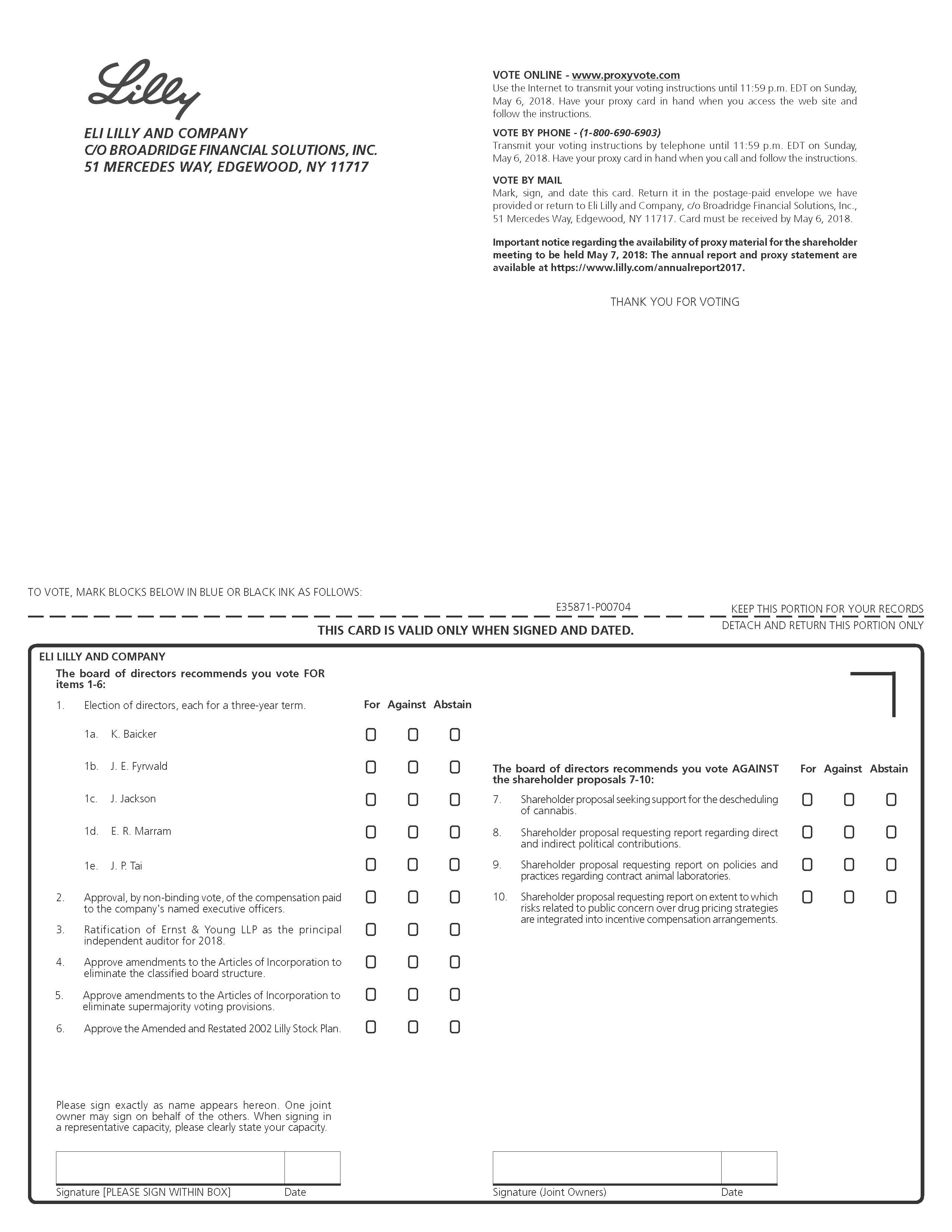

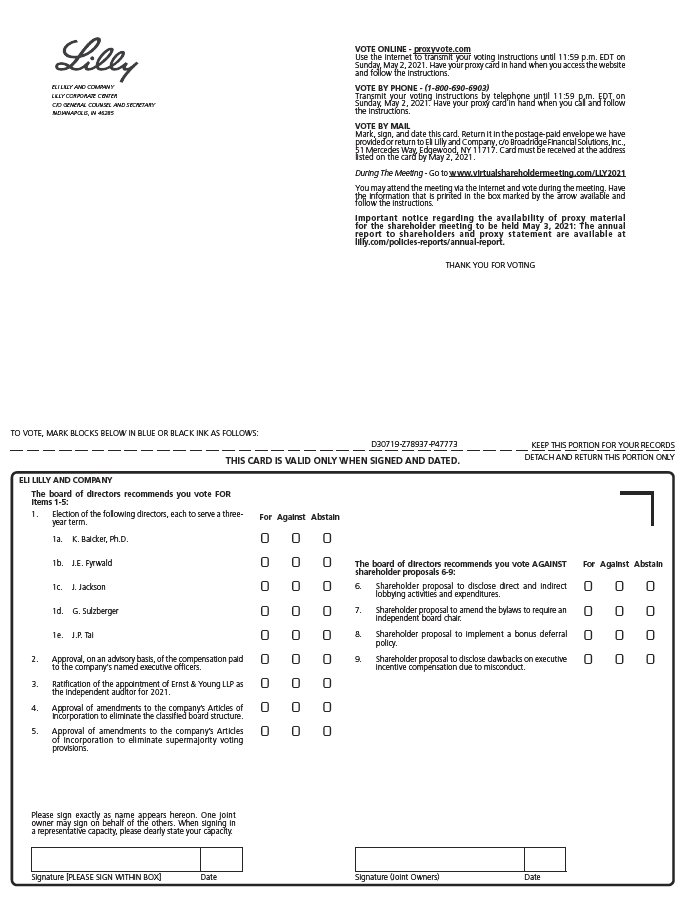

Even if you plan to attend the 2018 Annual Meeting, in person, we encourage you to vote prior to the meeting viausing one of the methods described below.

|  |  | ||||||

| ONLINE | BY TELEPHONE | BY MAIL | ||||||

| Visit the website listed on your notice, proxy card, or voting instruction form | Call 1-800-690-6903 using a touch-tone phone and follow the instructions provided | If you received or requested paper copies of your proxy materials, sign, date, and return your proxy card or voting instruction form | ||||||

Shareholders who hold their shares beneficially through an institutional holder of record, such as a broker or bank (sometimes referred to as holding shares in street name), will receive voting instructions from that holder of record. If you do not provide voting instructions to the website listedholder of record, your shares will not be voted on your proxy card or voting instruction formany proposal on which the broker does not have discretionary authority to vote ONLINE

vote. See "Other Information—Meeting and Voting Logistics—Voting Shares Held by a Broker" for more information.

Further information on how to vote, including if you hold voting shares in the 401(k) Plan, is provided at the end of thethis proxy statement under "Meeting"Other Information—Meeting and Voting Logistics."

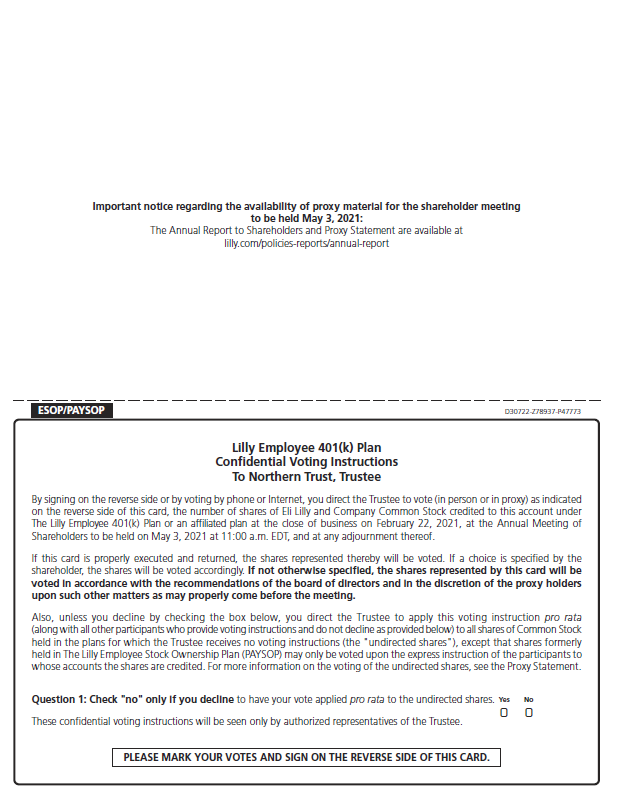

You may vote your shares prior to the Annual Meeting until 11:59 p.m. EDT on May 2, 2021 online or by telephone. If you are voting by mail, your marked, signed, and dated proxy card must be received by May 2, 2021. Shareholders who hold their shares in the 401(k) Plan must vote in advance of the Annual Meeting, by April 28, 2021, so the plan trustee can vote their shares accordingly. See "Other Information—Meeting and Voting Logistics—Voting Shares Held in the Company 401(k) Plan" for more information.

P12

Voting at our 2018Our 2021 Annual Meeting

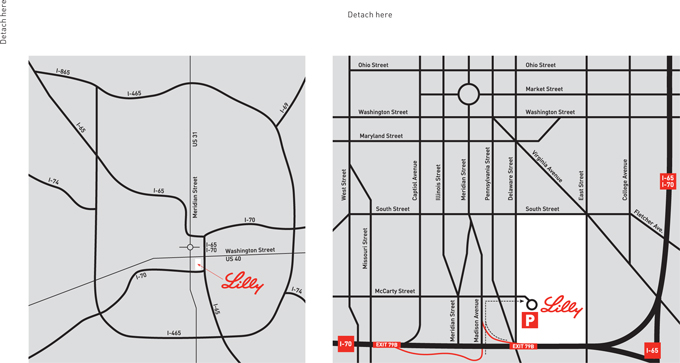

You may also opt to vote in person atby attending the 2018 Annual Meeting, which will be held online via live webcast at virtualshareholdermeeting.com/LLY2021on Monday, May 7, 2018, at the Lilly Corporate Center, Indianapolis, IN 46285,3, 2021, at 11:00 a.m., EDT. See the section titled "Meeting"Other Information—Meeting and Voting Logistics" for more information.

Governance

Item 1. Election of Directors

Under the company’sour articles of incorporation, the board is divided into three classes with approximately one-third of the directors standing for election each year. The term for directors to be elected this year will expire at the annual meeting of shareholders held in 2021.2024. Each of the director nominees listed below has agreed to serve that term. The following sections provide information about our directors,director nominees, including their qualifications, the director nomination process, and director compensation.

Board Recommendation on Item 1

The Board of Directorsboard recommends that you vote FOR each of the following director nominees:

•Katherine Baicker, Ph.D.

•J. Erik Fyrwald

•Jamere Jackson

•Gabrielle Sulzberger

•Jackson P. Tai

Board Operations and Governance

Board of Directors

Each of our directors is elected to serve until his or her successor is duly elected and qualified. If a bona fide nominee set forth in this proxy statement is unable to serve or for good cause will not serve, proxy holders may vote for another nominee proposed by the board or, as an alternative, the board may reduce the number of directors to be elected at the Annual Meeting.

Director Biographies

Set forth below is information, as of March 19, 2021, regarding our directors and director nominees, which has been confirmed by each of them for inclusion in this proxy statement. We have provided the most significant experiences, qualifications, attributes, and skills that led to the conclusion that each director or director nominee should serve as a director in light of our business and structure.

No family relationship exists among any of our directors, director nominees, or executive officers. To the best of our knowledge, there are no pending material legal proceedings in which any of our directors or nominees for director, or any of their associates, is a party adverse to us or any of our affiliates, or has a material interest adverse to us or any of our affiliates. Additionally, to the best of our knowledge, there have been no events under any bankruptcy laws, no criminal proceedings and no judgments, sanctions, or injunctions during the past 10 years that are material to the evaluation of the ability or integrity of any of our directors or nominees for director. There is no arrangement or understanding between any director or director nominee and any other person pursuant to which he or she was or is to be selected as a director or director nominee.

P13

Class of 2021

The five directors listed below will seek reelection at the Annual Meeting. See "Item 1. Election of Directors" above for more information.

| Katherine Baicker, Ph.D. Age: 49, Director since 2011, Board Committees: Ethics and Compliance (chair); Science and Technology | |||||||

| PUBLIC BOARDS | MEMBERSHIPS + OTHER ORGANIZATIONS | |||||||

| HMS Holdings Corp. | Panel of Health Advisers to the Congressional Budget Office; Advisory Board of the National Institute for Health Care Management; Editorial Board of Health Affairs; Research Associate of the National Bureau of Economic Research; Trustee of the Mayo Clinic, National Opinion Research Center, and the Chicago Council on Global Affairs; Member of the National Academy of Medicine, the National Academy of Social Insurance, the Council on Foreign Relations, and the American Academy of Arts and Sciences | |||||||

| CAREER HIGHLIGHTS | ||||||||

| • Harris School of Public Policy, University of Chicago | ||||||||

| - Dean and the Emmett Dedmon Professor (2017 - present) | ||||||||

| • Harvard T.H. Chan School of Public Health, Department of Health Policy and Management | ||||||||

| - C. Boyden Gray Professor (2014 -2017) | ||||||||

| - Acting Chair (2014 - 2016) | ||||||||

| - Professor of health economics (2007 - 2017) | ||||||||

| • Council of Economic Advisers, Executive Office of the President | ||||||||

| - Member (2005 - 2007) | ||||||||

| - Senior Economist (2001 - 2002) | ||||||||

| QUALIFICATIONS | ||||||||

| Dr. Baicker is a leading researcher in the fields of health economics and public economics. As a valued adviser to numerous healthcare-related commissions and committees, her expertise in healthcare policy and healthcare delivery is recognized in both academia and government. | ||||||||

P14

| J. Erik Fyrwald Age: 61, Director since 2005, Board Committees: Compensation; Science and Technology | |||||||

| PUBLIC BOARDS | PRIVATE BOARDS | NON-PROFIT BOARDS | ||||||

| Bunge Limited | Syngenta AG | UN World Food Program Farm to Market Initiative; CropLife International; Swiss-American Chamber of Commerce; Syngenta Foundation for Sustainable Agriculture (chair) | ||||||

| CAREER HIGHLIGHTS | ||||||||

• Syngenta AG, a global Swiss-based agriculture technology company that produces agrochemicals and seeds | ||||||||

| - President and Chief Executive Officer (2016 - present) | ||||||||

• Univar, Inc., a leading distributor of chemicals and provider of related services | ||||||||

| - President and Chief Executive Officer (2012 - 2016) | ||||||||

• Ecolab Inc., a leading provider of cleaning, sanitization, and water products and services | ||||||||

| - President (2012) | ||||||||

• Nalco Company, a leading provider of water treatment products and services | ||||||||

| - Chairman and Chief Executive Officer (2008 - 2011) | ||||||||

• E.I. duPont de Nemours and Company, a global chemical company | ||||||||

| - Group Vice President, agriculture and nutrition (2003 - 2008) | ||||||||

| QUALIFICATIONS | ||||||||

| Mr. Fyrwald has a strong record of operational and strategic leadership in complex worldwide businesses with a focus on technology and innovation. He is an engineer by training and has significant chief executive officer experience with Syngenta, Univar, and Nalco. | ||||||||

P15

| Jamere Jackson Age: 52, Director since 2016, Board

* Hertz Global Holdings Inc., The Hertz Corporation, and certain of their subsidiaries filed voluntary petitions for relief under chapter 11 of title 11 of the United States Code in May 2020. We do not believe this proceeding is material to an evaluation of the ability or integrity of Mr. Jackson.

P16

P17 Class of 2022 The following five directors are serving terms that will expire in May 2022.

P18

P19

P20

Class of 2023 The following five directors are serving terms that will expire in May 2023.

P21

P22

P23

P24 Director Qualifications and Nomination Process Director Qualifications Experience: Our directors are responsible for overseeing the company's business consistent with their fiduciary duties. This significant responsibility requires highly skilled individuals with various qualities, attributes, and professional experience. We believe the board is well-rounded, with a balance of relevant perspectives and experience, as illustrated in the following chart. Categories referencing "expertise" indicate that the director is an expert in the field, while "experience" indicates direct experience, including management and oversight of significant operations:

Board Tenure: As the following chart demonstrates, our director composition reflects a mix of tenure on the board, which provides an effective balance of historical perspective and an understanding of the evolution of our business with fresh perspectives and insights. Kathi Seifert, who joined the board in 1995, will retire from the board following the Annual Meeting. Effective January 25, 2021, Gabrielle Sulzberger was elected to the board as a member of the director class of 2021. Ms. Sulzberger was appointed to the Audit Committee and the Ethics and Compliance Committee. Effective February 16, 2021, Kimberly H. Johnson was elected to the board as a member of the director class of 2022. Ms. Johnson was appointed to the Compensation Committee and the Ethics and Compliance Committee. The following graphic highlights the tenure of our current board members: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less than 3 Years: | 3 | |||||||||||||||||||||||||

| 3-5 Years: | 4 | |||||||||||||||||||||||||

| 6-10 Years: | 4 | |||||||||||||||||||||||||

| More than 10 Years: | 4 | |||||||||||||||||||||||||

Diversity: The board strives to achieve diversity in the broadest sense, including persons diverse in geography, gender, ethnicity, age, and experiences. Although the board does not establish specific diversity goals or have a standalone diversity policy, the board's overall diversity is an important consideration in the director selection and nomination process. The Directors and Corporate Governance Committee assesses the effectiveness of board diversity efforts in connection with the annual nomination process as well as in new director searches. The company's 15 directors range in age from 48 to 71 and include six women and seven members of underrepresented groups (including minority group members (MGM) as well as lesbian, gay, bisexual, transgender, or queer (LGBTQ) individuals).

Character: Board members should possess the personal attributes necessary to be an effective director, including unquestioned integrity, sound judgment, a collaborative spirit, and commitment to the company, our shareholders, and other constituencies.

Director Refreshment

The results of these assessments inform the board's recommendations on nominations for directors at the annual meeting of shareholders each year and help provide us with insight on the types of experiences, skills, perspectives, and other characteristics we should be seeking for future director candidates. Based on this assessment, the committeeDirectors and

P25

Corporate Governance Committee has recommended that the directors in the 2018 class of 2021 be elected at the 2018 annual meeting.Annual Meeting.

The board delegates the director screening process to the Directors and Corporate Governance Committee, which receives input from other board members. Potential directorsDirector candidates are identified from several sources, including executive search firms retained by the committee, incumbent directors, management, and shareholders.

The Directors and Corporate Governance Committee has retained Russell Reynolds Associates, an executive search and leadership consulting firm, to assist with identifying potential director candidates.

The Directors and Corporate Governance committee employs the same process for evaluatingto evaluate all candidates, including those submitted by shareholders. The committee initially evaluates a candidate based on publicly available information and any additional information supplied by the party recommending the candidate. If the candidate appears to satisfy the selection criteria and the committee’s initial evaluation is favorable, the committee, assisted by management or a search firm, gathers additional data on the candidate’s qualifications, availability, probable level of interest, and any potential conflicts of interest. If the committee’s subsequent evaluation continues to be favorable, the candidate is contacted by the Chairmanchairman of the Boardboard and one or more of the independent directors, including the lead independentdirector, for direct discussions to determine the mutual level of interest in pursuing the candidacy. If these discussions are favorable, the committee recommends that the board nominate the candidate for election by the shareholders (or to selectelects the candidate to fill a vacancy, as applicable).

Cash Compensation

The following table shows the retainers and meeting fees in effect in 2020 for all non-employee directors in effect in 2017.directors:

Board and Committee Membership Retainers (annual, paid in monthly installments) | Leadership Retainers (annual, paid in monthly installments) | ||||||||||||||||||||||

| Annual board retainer | $110,000 | Lead independent director | $35,000 | ||||||||||||||||||||

| Audit Committee and Science and Technology Committee members (including the chairs) | $6,000 | Audit Committee chair | $18,000 | ||||||||||||||||||||

| Compensation Committee, Directors and Corporate Governance Committee, Finance Committee, and Public Policy and Compliance Committee (renamed the Ethics and Compliance Committee effective January 1, 2021) members (including the chairs) | $3,000 | Science and Technology Committee chair | $15,000 | ||||||||||||||||||||

| All other committee chairs | $12,000 | ||||||||||||||||||||||

| Board Retainers (annual, paid in monthly installments) | Committee Retainers (annual, paid in monthly installments) | ||||||

| Annual Board Retainer | $110,000 | Audit Committee; Science and Technology Committee members (including the chairs) | $6,000 | ||||

| Annual Retainers (in addition to annual board retainer): | Compensation Committee; Directors and Corporate Governance Committee; Finance Committee; Public Policy and Compliance Committee members (including the chairs) | $3,000 | |||||

| Lead Independent Director | $30,000 | ||||||

| Audit Committee Chair | $18,000 | ||||||

| Science and Technology Committee Chair | $15,000 | ||||||

| Compensation Committee Chair; Directors and Corporate Governance Committee Chair; Finance Committee Chair; Public Policy and Compliance Committee Chair | $12,000 | ||||||

Directors are reimbursed for customary and usual travel expenses in connection with their travel to and from board meetings and other company events. DirectorsNon-employee directors may also receive additional cash compensation for serving on ad hoc committees that may be assembledformed by the board from time to time.

Stock Compensation

A significant portion of non-employee director compensation is linked to the long-term performance of Lilly stock. In 2020, non-employee directors received an annual equity-based award valued at $175,000. The award was credited to each non-employee director’s deferred stock account established under the Lilly Directors’ Deferral Plan as a number of units calculated by dividing $175,000 by the closing stock price on a pre-set annual date (approximately 1,245 units). The units track the economic value of shares of company stock with stock dividends being deemed "reinvested" in additional units based on the market price of the stock on the date dividends are paid. The units become converted into and issuable to the non-employee directors as shares of company stock commencing on the second January following a director's departure from board service (either in lump sum or installments as described below). When applicable, the annual equity-based award is prorated for time served.

P26

Share Ownership Guidelines

Directors are required to hold meaningful equity ownership positions in the company, and may not sell the equity compensation they earn as a director until after leaving the board. A significant portion of director compensation is in the form of deferred Lilly stock payable after they leave the board. Directorscompany. Non-employee directors are required to hold Lilly stock, directly or through company plans,units representing the right to receive shares of Lilly stock under the Lilly Directors’ Deferral Plan, valued at not less than five times their annual board retainer; new non-employee directors are allowed five years to reach this ownership level. All non-employee directors serving at least five years have satisfied these guidelines, and allguidelines. All other non-employee directors are, or in the case of newly elected directors, are expected to begin, making progress toward these requirements.

Annual Compensation Cap for Directors

In 2017,2018, the board approved aan annual cap to the total annual compensation (retainers, fees,(cash and stock allocation)equity compensation) for non-employee directors of $800,000. The cap is intended to avoid excessive director compensation and is

included in both ourthe Lilly Directors' Deferral Plan and in the Amended and Restated 2002 Lilly Stock Plan being consideredapproved by shareholders at this year’sthe 2018 annual shareholders meeting.

meeting of shareholders.

Lilly Directors’ Deferral Plan: The

In addition to the annual equity-based grants credited to each non-employee director’s deferred stock account as described above, the Lilly Directors' Deferral Plan allows non-employee directors to defer receipt of all or part of their cash compensation until after their service on the board has ended. Each director can choose to invest theany amounts deferred in one or both of the following two accounts:

Deferred Stock Account. This account allows the non-employee director, in effect, to invest his or her deferred cash compensation in company stock. Funds in this account are credited as hypotheticalunits representing the right to receive shares of company stock based on the closing stock price on pre-set monthly dates. In addition, the annual stock compensation award as described above is also credited to this account. The number of shares credited is calculated by dividing the $160,000 annual compensation figure by the closing stock price on a pre-set annual date. Hypothetical dividends are “reinvested”deemed "reinvested" in additional sharesunits based on the market price of the stock on the date dividends are paid. ActualThe units become converted into and issuable to the non-employee director as shares are issuedof company stock commencing on the second January following the director's departure from board service.service (either in a lump sum or installments as described below). The deferral stock account is the same account where the annual equity-based awards are credited with the same conversion timing and procedure applicable to the annual equity-based awards.

Deferred Compensation AccountAccount.. FundsDeferred cash compensation in this account earnearns interest each year at a rate of 120 percent of the applicable federal long-term rate, compounded monthly, as established the preceding December by the U.S. Treasury Department under Section 1274(d) of the Internal Revenue Code of 1986 (the Internal Revenue Code). The aggregate amount of interest that accrued in 20172020 for the participating directors was $140,541,$109,753, at a rate of 2.72.5 percent. The rate for 20182021 is 3.11.6 percent.

Both accounts may generally only be paid out in a lump sum or in annual installments for up to 10 years beginningbased on individual director annual elections. All payments begin the second January following the director’s departure from board service. Amounts in the deferred stock account are paid in shares of company stock.

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)1 | All Other Compensation and Payments ($)2 | Total ($)3 | ||||||||||||||||||||||

| Mr. Alvarez | $131,000 | $175,000 | $0 | $306,000 | ||||||||||||||||||||||

| Dr. Baicker | $131,000 | $175,000 | $0 | $306,000 | ||||||||||||||||||||||

| Dr. Bertozzi | $119,000 | $175,000 | $0 | $294,000 | ||||||||||||||||||||||

| Mr. Eskew | $134,000 | $175,000 | $0 | $309,000 | ||||||||||||||||||||||

| Mr. Fyrwald | $119,000 | $175,000 | $55,600 | $349,600 | ||||||||||||||||||||||

| Mr. Jackson | $137,000 | $175,000 | $0 | $312,000 | ||||||||||||||||||||||

| Dr. Kaelin | $134,000 | $175,000 | $5,000 | $314,000 | ||||||||||||||||||||||

| Mr. Luciano | $163,000 | $175,000 | $0 | $338,000 | ||||||||||||||||||||||

| Dr. Runge | $119,000 | $175,000 | $0 | $294,000 | ||||||||||||||||||||||

| Ms. Seifert | $116,000 | $175,000 | $20,841 | $311,841 | ||||||||||||||||||||||

| Mr. Tai | $122,000 | $175,000 | $60,000 | $357,000 | ||||||||||||||||||||||

| Ms. Walker | $119,000 | $175,000 | $20,000 | $314,000 | ||||||||||||||||||||||

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)1 | All Other Compensation and Payments ($)2 | Total ($)3 | ||||

| Mr. Alvarez | $131,000 | $160,000 | $291,000 | |||||

| Dr. Baicker | $119,000 | $160,000 | $279,000 | |||||

| Dr. Bertozzi | $109,083 | $146,667 | $255,750 | |||||

| Mr. Eskew | $140,000 | $160,000 | $300,000 | |||||

| Mr. Fyrwald | $131,000 | $160,000 | $291,000 | |||||

| Mr. Hoover | $128,000 | $160,000 | $288,000 | |||||

| Mr. Jackson | $119,000 | $160,000 | $279,000 | |||||

| Dr. Kaelin | $134,000 | $160,000 | $294,000 | |||||

| Mr. Luciano | $116,000 | $160,000 | $276,000 | |||||

| Ms. Marram | $158,000 | $160,000 | $318,000 | |||||

| Dr. Runge | $119,000 | $160,000 | $279,000 | |||||

| Ms. Seifert | $119,000 | $160,000 | $279,000 | |||||

| Mr. Tai | $119,000 | $160,000 | $279,000 | |||||

| Retired | ||||||||

| Dr. Lechleiter | $129,167 | $66,667 | $195,834 | |||||

| Dr. Prendergast | $49,583 | $66,667 | $116,250 | |||||

*Ms. Sulzberger and Ms. Johnson were elected to the board of directors in 2021 and are not included in the table above.

1 Each non-employee director received an equity-based award of stockunits valued at $160,000$175,000 (approximately 1,924 shares), except Dr. Lechleiter and Dr. Prendergast, who retired from the board in May 2017, and Dr. Bertozzi, who joined the board in February 2017, who received a pro-rated award for a partial year of service. This stock award1,245 units). These units, and all prior stock awards of such units, are fully vested; however, the shares subject to such awards of units are not issued until the second January following the director's departure from board service when, as described above

P27

under “Lilly"Lilly Directors’ Deferral Plan.” Plan," the units are converted into shares of company stock and distributed to the former director.The column shows the grant date fair value for each director’s stockequity-based award computed in

accordance with FASB ASC Topic 718, based on the closing stock price on the grant date. See Note 1112 of the consolidated financial statements in the company’s Annual Report on Form 10-K for the fiscal year ended December 31, 20172020, for additional detail regarding assumptions underlying the valuation of equity awards. Aggregate outstanding stock awards are shown in the “Common"Common Stock Ownership by Directors and Executive Officers”Officers" table in the “Stock"Stock Units Not Distributable Within 60 Days”Days" column.

3 Directors do not participate in a company pension plan or non-equity incentive plan.

2021 Director Compensation

The Directors and Corporate Governance Committee performs regular reviews of non-employee director compensation. In 2017,2019, the Directors and Corporate Governance Committee reviewed the company’sperformed an in depth review of non-employee director compensation, for independent directors, including a pharmaceutical company peer group analysis. As a resultanalysis and general industry peer group analysis conducted with the assistance of this analysis,an outside compensation consultant, discussions regarding the committee recommended, andeffectiveness of the board approved an increase in the annual stock award for non-employee directors from $160,000in their various duties, and other considerations, including the desire to $175,000 (but retained the cap of 7,500 shares) to be effective starting with the 2018 stock award. The increase reflected a market increase in totalhave non-employee director compensation whichpositioned near the committee proposed as an increase to equity rather than cash compensation. In addition,market median when compared against the committee recommended, andgeneral industry peer group. Although no formal changes or review of the board approved, an increase to the lead independent director's retainer from $30,000 to $35,000 to reflect increased expectations for the role over time. All othernon-employee director compensation remains unchanged from 2017.were made or conducted in 2020, the Directors and Corporate Governance Committee intends to perform a non-employee director compensation review as part of its 2021 agenda.

Director Independence

The board annually determines the independence of directors based on a review and recommendation by the Directors and

Corporate Governance Committee. No director is considered independent unless the board has affirmatively determined that he or she has no material relationship with the company, either directly or as a partner, significant shareholder, or officer of an organization that has a material relationship with the company. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable, and familial relationships, among others. To evaluate the materiality of any such relationship, the board has adopted categorical independence standards consistent with the New York Stock Exchange (NYSE) listing standards, except that the “look-back period”"look-back period" for determining whether a director’s prior relationship(s)relationships with the company impairs independence is extended from three to four years.

The company's process for determining director independence is set forth in our Standards for Director Independence, which can be found on our website at https://www.lilly.com/who-we-are/lilly.com/leadership/governance, along with our Corporate Governance Guidelines.

On the recommendation of the Directors and Corporate Governance Committee, the board determined that each current non-employee director is independent. Prior to expiration of hisThe board term in 2017, the board reached the same conclusion regarding Dr. Prendergast, andalso determined that the members of each committeeour Audit and Compensation Committees also meet ourthe heightened independence standards.standards applicable to those committees. The board determined that none of the non-employee directors has had during the last four years (i) any of the relationships identified in the company’s categorical independence standards or (ii) any other material relationship with the company that would compromise his or her independence. The table that follows includes a description of categories or types of transactions, relationships, or arrangements

In making its independence determinations, the board considered in reaching its determinations.

P28

•whether any transactions were entered into at arm's length in the normal course of business and, to the extent they are commercial relationships, have standard commercial terms; and

•whether any director had any direct business relationships with the company or received any direct personal benefit from any of these transactions, relationships, or arrangements.

Committees of the Board of Directors

The duties and membership of the sixour board-appointed committees are described below. Effective January 1, 2021, our board disbanded the Finance Committee and reallocated its duties to the full board, the Audit Committee, and the Compensation Committee. This restructuring reduced the number of board committees to allow more time for meetings of the remaining committees, encouraging longer, more in-depth committee discussions, and allowing the board to have more in-depth discussions on capital allocation matters.

All committee members are independent as defined in the NYSE listing requirements and Lilly's independence standards. The members of the Audit and Compensation Committees each meet the additional independence requirements applicable to them as members of those committees.

The Directors and Corporate Governance Committee makes recommendations to the board regarding director committee membership and selection of committee chairs. The board has no set policy for rotation of committee members or chairs but annually reviews committee memberships and chair positions, seeking the best blend of continuity and fresh perspectives.perspectives on the committees.

The chair of each committee determines the frequency and agenda of committee meetings. The Audit, Compensation,meetings, subject to any minimums specified in the relevant committee charter, and Public Policy and Compliance Committeesthe committees meet alone in executive session on a regular basis; all other committees meet in executive session as needed.basis.

P29

Membership and Meetings of the Board and Its Committees

In 2017,2020, each director attended at least 8075 percent of the total number of meetings of the board and the committees on which he or she served during his or her tenure as a board or committee member. In addition, all board members are expected to attend the annual meeting of shareholders,Annual Meeting, and all directors then serving attended the 2020 annual meeting in 2017.of shareholders. Current committee membership and the number of meetings of the board and each committeecommittee* held in 20172020 are shown in the table below.

| Name | Board | Audit | Compensation | Directors and Corporate Governance | Ethics and Compliance | Science and Technology | ||||||||||||||

| Mr. Alvarez | ü | ü | C | |||||||||||||||||

| Dr. Baicker | ü | C | ü | |||||||||||||||||

| Dr. Bertozzi | ü | ü | ü | |||||||||||||||||

| Mr. Eskew | ü | ü | C | |||||||||||||||||

| Mr. Fyrwald | ü | ü | ü | |||||||||||||||||

| Mr. Jackson | ü | C | ü | |||||||||||||||||

| Ms. Johnson** | ü | ü | ü | |||||||||||||||||

| Dr. Kaelin | ü | ü | C | |||||||||||||||||

| Mr. Luciano | LD | ü | ü | |||||||||||||||||

| Mr. Ricks | ü | |||||||||||||||||||

| Dr. Runge | ü | ü | ü | |||||||||||||||||

| Ms. Seifert | ü | ü | ü | |||||||||||||||||

| Ms. Sulzberger** | ü | ü | ü | |||||||||||||||||

| Mr. Tai | ü | ü | ü | |||||||||||||||||

| Ms. Walker | ü | ü | ü | |||||||||||||||||

| Number of 2020 Meetings | 10 | 9 | 6 | 4 | 6 | 9 | ||||||||||||||

| Name | Board | Audit | Compensation | Directors and Corporate Governance | Finance | Public Policy and Compliance | Science and Technology |

| Mr. Alvarez | ü | C | ü | ||||

| Dr. Baicker | ü | ü | ü | ||||

| Dr. Bertozzi | ü | ü | ü | ||||

| Mr. Eskew | ü | C | ü | ü | |||

| Mr. Fyrwald | ü | C | ü | ||||

| Mr. Hoover | ü | ü | C | ||||

| Mr. Jackson | ü | ü | ü | ||||

| Dr. Kaelin | ü | ü | C | ||||

| Mr. Luciano | ü | ü | ü | ||||

| Ms. Marram | LD | ü | C | ||||

| Mr. Ricks | ü | ||||||

| Dr. Runge | ü | ü | ü | ||||

| Ms. Seifert | ü | ü | ü | ||||

| Mr. Tai | ü | ü | ü | ||||

| Number of 2017 Meetings | 8 | 10 | 8 | 6 | 8 | 4 | 8 |

** Ms. Sulzberger and Ms. Johnson were elected in 2021.

C Committee Chair

LD Lead Independent Director

All six committee charters are available online at https://www.lilly.com/who-we-are/lilly.com/leadership/governance, or upon request to the company's corporate secretary.. Key responsibilities of each committee are set forth below.

Audit Committee

•the integrity of financial information provided to theour shareholders and others

•management's systems of internal controls and disclosure controls

•the performance of internal and independent audit functions

•the company's compliance with legal and regulatory requirements.requirements

•processes and procedures related to identifying and mitigating enterprise level risks.

The committee has sole authority to appoint or replace the independent auditor, subject to shareholder ratification.

The Board of Directorsboard has determined that Mr. Alvarez, Mr. Eskew, Mr. Jackson, Ms. Sulzberger, and Mr. Tai are audit committee financial experts, as defined in the SEC rules.rules of the U.S. Securities and Exchange Commission (SEC).

Compensation Committee

The Compensation Committee:

•oversees the company’s global compensation philosophy and policies

•establishes the compensation of our chief executive officer (CEO)CEO, in consultation with other independent directors and our external compensation consultant, and other executive officers

P30

•acts as the oversight committee with respect to the company’s deferred compensation plans, management stock plans, and other management incentive compensation programs

•reviews succession plans for the CEO and other key senior leadership positions, including a broad review of our succession management and diversity efforts

•advises our management and the board regarding other human capital management and employee compensation and benefits matters

•reviews, monitors, and oversees stock ownership guidelines for executive officers.officers

•oversees the company’s executive compensation recovery policy

•oversees the company’s engagement with shareholders regarding executive compensation matters, including reviewing and evaluating the results of advisory votes on executive compensation.

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2020, Mr. Alvarez, Mr. Eskew, Mr. Fyrwald, and Ms. Seifert served on the Compensation Committee.

None of the Compensation Committee members:

•has ever been an officer or employee of the company

•is or has been a participant in a related person transaction with the company (see “Review"Governance—Highlights of the Company's Corporate Governance—Conflicts of Interest and Transactions with Related Persons—Review and Approval of Transactions with Related Persons”Persons" for a description of our policy on related person transactions)

•has any other interlocking relationships requiring disclosure under applicable SEC rules.

Directors and Corporate Governance Committee

The Directors and Corporate Governance Committee:

•leads the process for director recruitment, together with the lead independentdirector

•oversees matters of corporate governance, including board performance, non-employee director independence and compensation, corporate governance guidelines, and shareholder engagement on governance matters.matters

•identifies and brings to the attention of the board as appropriate current and emerging environmental, social, political, and governance trends and public policy issues that may affect the business operations

•annually assesses the performance of the board, board committees and board processes, and reviews such findings with the board.

Ethics and Compliance Committee

Effective January 1, 2021, the board reorganized the Public Policy and Compliance Committee into the Ethics and Compliance Committee.

The Ethics and Compliance Committee:

•reviews, identifies and, when appropriate, brings to the attention of the board legal and regulatory trends and issues, and compliance and quality matters that may have an impact on the business operations, financial performance, or reputation of the company

•reviews, monitors, and makes recommendations to the board on corporate policies and practices related to compliance, including those related to employee health and safety.

Science and Technology Committee

The Science and Technology Committee:

•reviews and advises the board regarding the company’s strategic research and development goals and objectives

•monitors and evaluates developments, technologies, and trends in pharmaceutical research and development

•regularly reviews the company's product pipeline

•advises the board on the scientific aspects of significant business development opportunities

•assists the board with its oversight responsibility for enterprise risk management in areas affecting the company's research and development.

Finance Committee

•capital structure and strategies

•dividends

•stock repurchases

•capital expenditures

P31

•investments, financing, and borrowings

•benefit plan funding and investments

•financial risk management

•significant business development opportunities.

Effective January 1, 2021, the board disbanded the Finance Committee and reallocated its responsibilities to the full board, the Audit Committee, and the Compensation Committee.

Board Oversight of Strategy, Compliance, and Risk Management

The board takes an active approach to its role in overseeing the development and execution of the company’s business strategies. On an annual basis, the board and executive management conduct an extended review and discussion of the company’s strategy, reviewing goals, the external environment, key questions, and key risks. Board meetings include discussions of company performance relative to the strategy. The board also reviews strategic focus areas for the company, such as innovation, information security, cybersecurity, and human capital management. See also "Governance—Highlights of the Company’s Corporate Governance—Human Capital Management."

The board, together with its committees, oversees the processes by which the company conducts its business to ensure the company operates in a manner that complies with laws and regulations and reflects the highest standards of integrity. Effective January 1, 2021, the Public Policy and Compliance Committee was reorganized to become the Ethics and Compliance Committee, with a refined focus on legal and regulatory trends and issues, and compliance and quality matters that may have an impact on the business operations, financial performance, or reputation of the company. The Ethics and Compliance Committee continues to meet at least four times per year, including semi-annual private sessions to discuss compliance with the company’s chief ethics and compliance officer, the general auditor, and the senior vice president, global quality. On an annual basis, the full board reviews the company's overall state of compliance and the Ethics and Compliance Committee receives an update on compliance at each meeting.

The chief ethics and compliance officer and the senior vice president, global quality report directly to the CEO.